By Julian Lee

Tropical storms have a nasty habit of tearing through the Gulf of Mexico and surrounding states during the warmest months of the year. On top of their huge potential human cost, they can knock out oil production and refining, pipelines and ports, causing disruptions that can last for weeks.

Normally, the impact on the oil and gas supply chains — and on prices — is fairly localized. Not this year.

The Gulf of Mexico has become hugely important to global oil balances, as the world struggles to cope with meeting strong post-Covid demand alongside eroded spare production capacity in OPEC countries and reduced supplies of oil and gas from Russia.

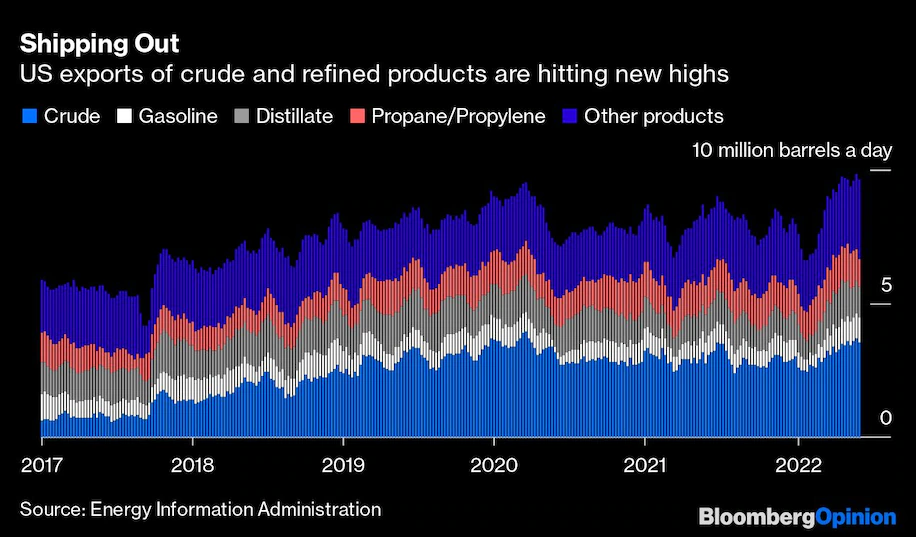

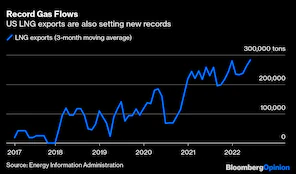

The US has stepped in, with record volumes of both oil and gas being shipped out of terminals, most of them on the Gulf coast, to buyers in Europe and Asia. A big storm, or a succession of storms as we saw in 2005 or 2008, would put those flows at risk, perhaps for several weeks.

And it’s not just offshore production and the refineries in Louisiana and Texas that would be affected. Oil supply is already being topped up with the biggest ever withdrawal of crude from the Strategic Petroleum Reserve, located in four sites — you’ve guessed it — along the Gulf of Mexico coast.

A major storm would also disrupt the US’s ability to make the refined products that are in short supply almost everywhere. While the country has large emergency stores of crude, it has virtually none of refined products. With a big refining sector, commercial inventories have historically done the job of ensuring an uninterrupted supply of products to consumers. But stockpiles of key products, like gasoline and diesel, are close to multi-year lows for the time of year.

At the start of June, for example, the volume of gasoline stored was the lowest since 2014. And although distillate fuel inventories are starting to rise in line with their normal seasonal pattern, they are still the lowest for this time of year since 2005. The country isn’t well placed to deal with disruptions.

Yet most forecasters see an active hurricane season. The US National Oceanic and Atmospheric Administration has said there will be 14 to 21 named storms, while Colorado State University puts the figure at 20 in its latest outlook. The first, Alex, flooded parts of Florida earlier this month. In comparison, an average season has 14 named storms.

Powerful winds, high tides and storm surges will put overseas shipments at risk, spreading the impact of any storm far beyond US shores. Exports of crude and refined products are running close to 10 million barrels a day.

European countries, scrambling to replace supplies from Russia after the Kremlin-backed invasion of Ukraine, secured almost 49 million barrels of US crude in April. The volume slipped in May, but is likely to rebound as European Union sanctions on seaborne imports of Russian crude come into force.

Gas shipments are also at risk. All five operational liquified natural gas export terminals are located along the Gulf of Mexico coast between Corpus Christi in Texas and Lake Charles in Louisiana — potentially putting them in the path of hurricanes.

An explosion and fire at Freeport LNG in Texas on Wednesday, unrelated to storms, is expected to put the plant out of operation for at least three weeks, and possibly much longer. News of the fire prompted an immediate 16% jump in already-high European natural gas prices.

This year, it’s not just going to be Gulf coast residents and US consumers that will worry about hurricanes. The impact of a major storm is going to be felt around the world.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

___________________________________________________________________

Julian Lee is an oil strategist for Bloomberg First Word. Previously he worked as a senior analyst at the Centre for Global Energy Studies.@JLeeEnergy, Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg, on June 13 , 2022. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

energiesnet.com 06 20 20022