- Prices of defaulted sovereign and oil notes rise Monday

- Chevron license improves outlook, but traders remain cautious

Nicolle Yapur and Maria Elena Vizcaino, Bloomberg News

CARACAS

EnergiesNet.com 11 29 2022

Defaulted Venezuelan bonds gained Monday following a breakthrough on political negotiations and a license from the US allowing Chevron Corp. to resume oil production in the sanctioned country.

Sovereign and state oil company notes rose as investors wager the Biden administration will be more willing to ease restrictions, including a potential lifting of sanctions that prohibit US investors from buying the country’s debt. President Nicolas Maduro and the opposition ended a yearlong standoff over the weekend and resumed negotiations, prompting Washington to grant Chevron’s license.

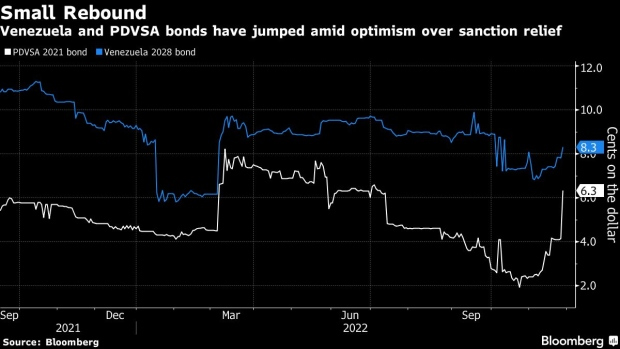

Although they are still deeply distressed, the nation’s dollar notes rose to 9 cents on the dollar, about one cent higher than last week. Bonds maturing in 2021 sold by Petroleos de Venezuela SA jumped to 6 cents from around 4 cents last week, according to data compiled by Bloomberg.

While the gains reflect a rare glint of optimism in a normally dead market, traders dismiss the notion that a long-term rally is underway.

“It’s difficult for the bonds to gain more going into year end,” said Ramiro Blazquez, head of research and strategy at BancTrust. “I’d say we need more evidence of bigger steps when it comes to negotiations and political concessions from Maduro’s side.”

Delegations representing Maduro and the opposition on Saturday signed a deal to use about $2.7 billion in frozen funds to finance a humanitarian plan that includes repairs to the country’s failing electricity grid. Hours later, the Biden administration published new rules allowing Chevron to expand operations in Venezuela and resume crude exports to the US.

The move is unlikely to result in a significant spike of oil production, but it signals to investors that the trading ban imposed by US sanctions on Venezuelan debt could be modified in the future.

It also sets the stage for marginal bondholders to consider alternative investment plans, such as as debt-for-equity deals, said Francesco Marani, head of trading at Madrid-based Auriga Global Investors. He says prices of sovereign and PDVSA bonds could surpass 10 and 7 cents respectively by the end of the year.

Traders are now looking at whether the two sides can continue to make progress, including setting conditions for the 2024 presidential election. Several previous rounds of talks have collapsed after they reached only minor agreements.

“Any further progress is likely to be slow, based on previous rounds of diplomacy, and could stall or even reverse if Maduro does not appear committed to the process,” London-based Medley Advisors’ analysts Richard Bronze and Pilar Navarro wrote in a note to clients.

bloomberg.com 11 28 2022

Let’s celebrate the strength, courage and incredible contributions of women around the world. https://www.EnergiesNet.com Portal of Latin America and the Caribbean with news and information on Energy, Oil, Gas, Renewables, Engineering, Technology and Environment

Let’s celebrate the strength, courage and incredible contributions of women around the world. https://www.EnergiesNet.com Portal of Latin America and the Caribbean with news and information on Energy, Oil, Gas, Renewables, Engineering, Technology and Environment