- Venezuela government defaulted on $60 billion of bonds in 2017

- Opposition’s offer would need to be endorsed by the US

Nicolle Yapur and Andreina Itriago Acosta, Bloomberg News

CARACAS

EnergiesNet.com 08 08 2023

Venezuela’s opposition-led National Assembly is finalizing an agreement with international creditors to extend a legal deadline on $60 billion of defaulted bonds that threatened to trigger an avalanche of litigation, according to people with knowledge of the plan.

The accord being drafted by the National Assembly — which is recognized in the US as the country’s legal representative — will suspend an upcoming statute of limitations on the debt.

The assembly is scheduled to discuss the topic on Tuesday, according to an agenda released by their communications team that didn’t give details on the proposals. Without a deal, bondholders have said they will sue in US courts to protect their rights to payment, potentially burying the country in legal action that would complicate any eventual restructuring process. The bonds have accrued roughly $30 billion of interest since Venezuela began defaulting in 2017.

An agreement to extend the deadline would be valid until the end of 2028, one person said. The US would need to endorse the agreement for it to take effect. Negotiations are still ongoing, so the terms could change.

Press officials at the State Department didn’t reply to questions from Bloomberg on whether the US government would support such a move. Opposition representatives didn’t respond to multiple requests for comment.

Hans Humes, head of Greylock Capital Management, a member of a creditor committee that holds over $10 billion of the debt, said an agreement is needed because US policy toward Venezuela has resulted in a “legal quagmire.” The US stopped recognizing President Nicolás Maduro in 2019.

“It’s good to know that Venezuelans across the political spectrum realize how damaging the wave of comprehensive litigation would be,” he said.

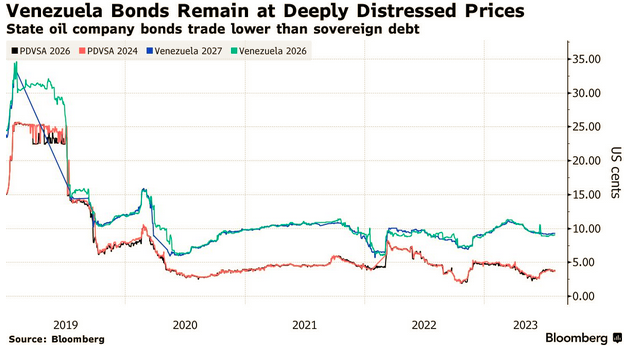

The government and state-owned oil company bonds trade at deeply distressed levels, as low as 4 cents on the dollar. US investors are prohibited from buying them due to Trump-era economic sanctions against the country.

Maduro’s government made a similar offer in March, offering to suspend the statute for five years or until the US government lifted sanctions that are preventing a debt restructuring.

READ: Venezuela Offers to Suspend Deadline on $60 Billion of Bonds

However, it wasn’t enforceable in the US since he’s not recognized as Venezuela’s president. In order to be valid, a standstill could only come from the opposition.

— With Philip Sanders

bloomberg.com 08 07 2023