Jack Wittels | Bloomberg

LONDON

EnergiesNet.com 02 07 2023

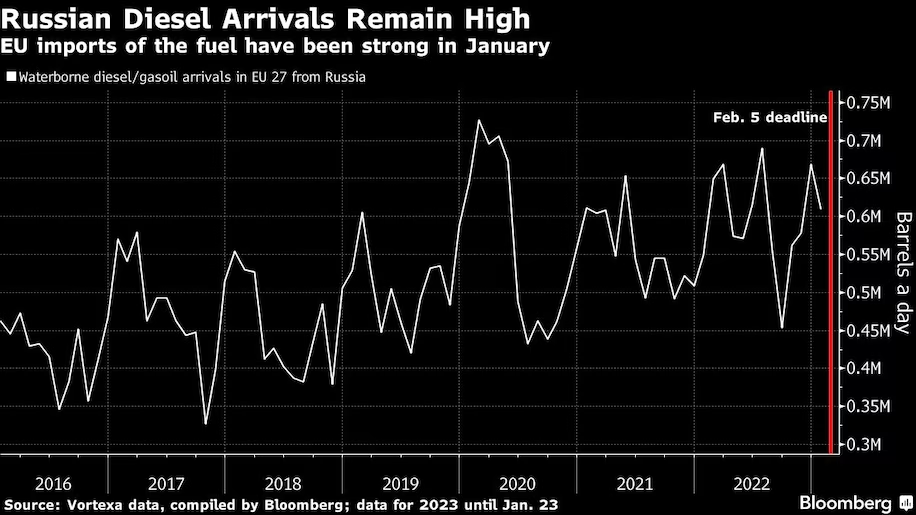

The campaign by western nations to defund the Kremlin and force President Vladimir Putin to abandon his war in Ukraine has reached a delicate phase. On Feb. 5, the European Union joined the UK and the US in banning seaborne imports of Russian diesel and other oil products. The measure, coupled with a price cap on Russian fuel exports, is designed to blow a sizable hole in Moscow’s energy revenues. The flip side: If European buyers are unable to find alternative supplies, the sanctions will heap new costs on diesel-reliant industries such as farming and road haulage and make it harder for governments to rein in inflation.

1. Wasn’t Russian oil already under European sanctions?

Yes, but those applied to unrefined crude oil, which is subject to European bans and a $60-per-barrel price cap imposed on entities still buying from Russia. The new sanctions affect seaborne Russian refined fuels. The country is also a major exporter of naphtha — which can be used to make gasoline and plastics — and fuel oil, which is often consumed in power generation and shipping. It also ships jet fuel, vacuum gasoil and other petroleum products. In all, Russia accounted for 9.3% of global oil product cargoes by volume in 2022, about 0.5 percentage points more than its share of the crude market, so the latest EU sanctions are just as significant.

2. How does the price cap work?

The same way as the cap on crude devised by countries including the Group of Seven nations and the EU. Anybody paying above the cap for products shipped from Russia won’t be able to obtain insurance and financing from key participating nations. That’s a big deal, given that more than 95% of the world’s oceangoing tankers are insured through London. The idea is that, even if buyers in Africa and elsewhere are willing to buy Russian diesel above the capped price, the bulk of the world’s tankers won’t be able to ship it. As oil product prices vary, the EU decided to set a cap of $100 per barrel on Russian premium fuels including diesel and $45 for those that sell at a discount, such as fuel oil and some types of naphtha.

3. How will EU buyers replace Russian fuel?

One of their trickiest challenges will be substituting diesel-type products that power cars, trucks, farm machinery, ships, manufacturing and construction equipment. About 220 million barrels were shipped to the bloc from Russian ports in 2022 — enough to fill about 14,000 Olympic-sized swimming pools. Suppliers in the Middle East, where new refineries are ramping up, are an obvious alternative. India and the US could also help fill the gap.

4. Will it be enough?

It depends partly on whether firms in China use increased export quotas to make more oil products available to the global market. That should free up extra barrels to ship to the EU. The higher quota doesn’t necessarily mean all possible exports will happen, especially with China’s economy opening back up after Beijing abandoned its strict Covid Zero policy. There’s also the question of whether Russia will keep exporting diesel. If it does, global trade flows will essentially be re-shuffled. There would still be the same amount of Russian fuel in the world, only it would be shipped to different places. However, if Russia can’t find enough buyers and is ultimately forced to cut production, that could drain global availability. French oil sector strikes further complicate the picture, given the potential for disruption at refineries that could reduce the EU’s own output.

5. What’s the EU’s ideal outcome?

EU leaders hope the new penalties will make a dent in Russia’s finances without causing an energy supply shock that disrupts key industries and makes it harder for governments to bring inflation under control. Setting the price cap too low would have meant Russian firms could refuse to sell, or would work harder to find ways around it. Too high, and they would merely suffer the inconvenience of having to find new buyers. Potential replacement customers for Russian fuels include Turkey as well as countries in Africa and Latin America.

6. Could there be unintended consequences?

It’s possible that some Russian fuel will be shipped at uncapped prices via a “shadow” tanker fleet that isn’t reliant on western services. Some nations may be in line for a windfall if they essentially buy Russian diesel at capped prices to cover their domestic requirements and sell fuel from their own refineries to EU buyers at a much higher price. There’s also little to stop buyers outside the EU such as India from purchasing Russian crude, processing it in their own refineries to make fuels, then legitimately selling those barrels to buyers in the EU. Traders willing to break the rules entirely could ship Russian fuel to one country, mix it in with other fuel (or just relabel it) and send it to the EU. It can be very hard to prove the true origin of such cargoes.

bloomberg.com 02 06 2023