- The surge in crude prices after a surprise production cut by OPEC+ countries underscores the danger of relying on unpredictable fossil-fuel producers.

Will Mathis, Bloomberg News

LONDON

EnergiesNet.com 04 04 2023

The immediate reaction to a surprise decision by OPEC+ to cut production was straightforward enough — oil prices surged the most in more than a year. How that will impact the global campaign to end the use of planet-warming fossil fuels is less clear.

In the past year, soaring energy prices and Russia’s invasion of Ukraine have been accelerants and a curse for the transition away from dirty fuels. While they’ve underscored the downside of relying on commodities controlled by a handful of countries, the sudden crunch has pushed even the most climate-progressive nations to turn to coal and gas as a backup.

The latest OPEC-driven price shock is no different.

“The higher the cost of traditional fuels, the bigger the incentive to continue the transition,” said Ole Sloth Hansen, head of commodity strategy at Saxo Bank. “That’s also a reason why OPEC isn’t out there to kill their market by supporting a return above $100 a barrel. That would hurt demand and speed up the transition.”

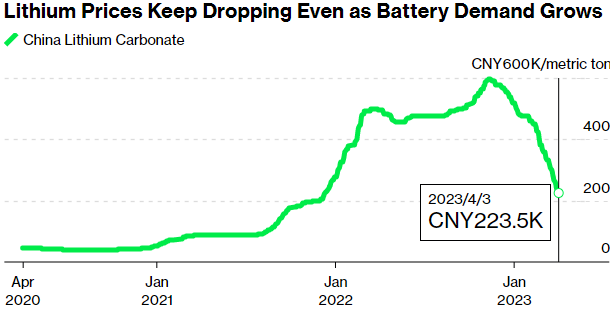

Oil producers have to take into account competing alternatives for their product like never before. Just as they’re sending the price of a barrel of oil up, green technologies and materials are starting to get cheaper again after two years of rising costs. Just look at lithium. While oil soared, the price of the battery and electric-vehicle material recorded its 16th straight trading day of losses on Tuesday. It’s down over 58% so far this year. That’s made it easier for carmakers such as Tesla Inc. to slash prices as more and more EVs hit the market.

The price of other important materials have fallen as well. Solar-grade polysilicon, used to make panels, is more than 30% cheaper than last year’s peak. The steel used in wind turbines has dropped 40% in Europe and more than 20% in North America from their high in 2022.

Still, while costlier oil may make EVs and other alternatives more attractive, it’s not easy to make an immediate switch. And in the meantime OPEC+’s production cut could lead to more extraction by other nations, especially the US, though the impact will likely be relatively small.

Western oil majors on both sides of the Atlantic have been firm in their mission to spend their record profits on rewards for their shareholders, rather than massive increases in new production. Despite repeated overtures from the Biden administration last year, US producers have remained reluctant to drill more out of caution of falling into another boom and bust cycle.

“You might see marginally higher oil and gas investment in shale,” said Will Hares, an analyst at Bloomberg Intelligence. “But energy majors won’t be adjusting transition plans” because of OPEC+’s production cut.

The bigger risk to the energy transition is that elevated oil prices will help fuel inflation that’s spurred central banks to rapidly raise interest rates in the past year. That’s already upended the financing of some large-scale renewable energy projects that have relied for years on cheap debt. Along with a stronger US dollar, it could also make it more expensive to mine the critical metals that are necessary to produce technologies such as batteries, wind turbines and cables, according to Saxo Bank’s Hansen.

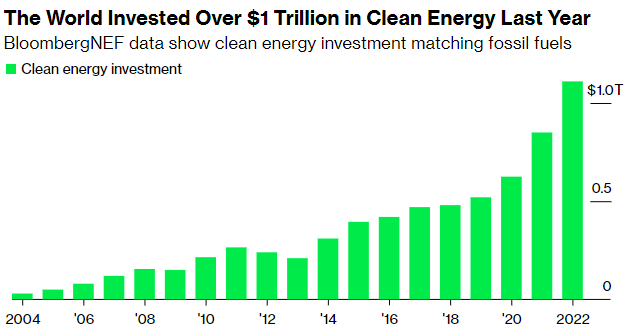

Ultimately though, any negative impact of OPEC+’s production cut will likely pale in comparison to other factors that are driving the longer-term march toward decarbonization, according to Torsten Lichtenau, a partner at Bain & Co.

The price of oil will continue to fluctuate, reinforcing the lesson that Russia’s invasion of Ukraine last year taught the world on the importance of reliable, domestic energy sources. Renewables are increasingly seen not just as a way to cut carbon, but also as a way to limit dangerous exposure to unpredictable fossil-fuel producers.

“Energy security has a much larger impact on the energy transition,” said Lichtenau. “Long-term it will accelerate the energy transition much more than a production cut supporting the oil price will do.”

bloomberg.com 04 04 2023