W. Schreiner Parker, Rystad Energy

OSLO

EnergiesNet.com 08 23 2023

The Andean country of Ecuador, once regarded as an island of relative tranquility in a troubled sea, has recently begun to resemble its neighbors in terms of instability and unpredictability. The only thing that seems to remain predictable is the decline in oil output from the former member of OPEC. The current outgoing president, Guillermo Lasso, had a focus on increasing production and investments in the oil sector, but those policies are now in doubt as Lasso enacted the famous ‘muerte cruzada’ and ended his term while calling for snap elections. Lasso’s inability to finish out his term may be a warning of a more dramatic trend in Latin America. In general, political oscillations in rapid succession often come at the expense of a more long-term energy policy which requires continuity in attention and investment. In the Ecuadorian oil industry, the question will be if a new government is willing to give either.

To a certain extent, the population has already made their position known in this space. Voters approved a referendum to halt oil extraction in Block 43. This block sits at the eastern edge of the Yasuni National Park and accounts for around 12% of total Ecuadorian oil output. The binding referendum mandates the project be abandoned by next year, meaning Ecuador will lose a little under 60,000 barrels per day of production. It also means the country will lose out on the revenue associated with that production, revenue Fitch Ratings estimates to be around US$600 million per year. For a cash-strapped nation like Ecuador, this government revenue is essential, but it seems some politicians are willing to do without. With Rafael Correa’s Revolución Ciudadana party candidate in the lead for the runoff, it’s questionable whether a new leftist president in today’s world wants to associate themselves with oil extraction at all, much like Colombia’s president Gustavo Petro. What this all means for Ecuador and its oil industry is yet to be fully understood. For now, uncertainty reigns supreme.

What impact will El Niño have on South America’s power markets?

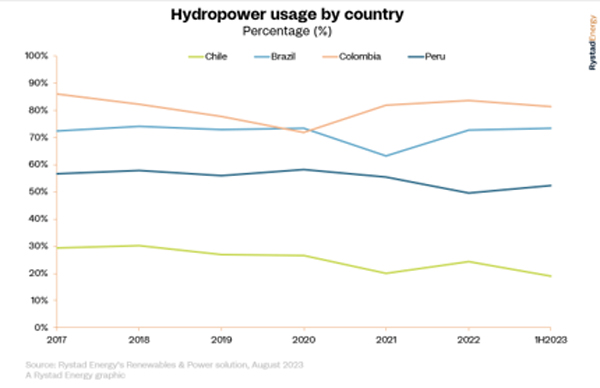

The year-long moderate Niño phenomenon forecast to start during the Austral summer (November 2023 to February 2024) could pose challenges for several power markets in the southern hemisphere through 2024, including those in South America. El Niño is typically associated with higher temperatures across South America, which pushes up power demand for cooling. It also has a varying regional impact on rainfall levels, leading to higher-than-average precipitation in some countries and lower-than-average levels in others. With hydropower of prime importance in many South American countries, El Niño’s impact on temperature and rainfall levels could challenge load and generation use through 2024. At the same time, varying economic growth and retail tariffs can weigh on electricity demand and, in some countries, could suppress El Niño’s impacts through 2024. Our analysis shows that the upcoming El Niño event will impact South America’s power markets during 4Q 2023 and 1H 2024, though this will vary between countries and in intensity. Colombia is likely to be the market most affected, leading to a tightened energy balance and higher prices, while heavy rains should increase hydro output in Peru. Thanks to its high reservoir levels and robust pipeline of renewable energy projects, Brazil is expected to remain largely shielded from El Niño at a power system level.

El Niño is a year-long (autumn to autumn) climatic phenomenon characterized by unusually warm ocean temperatures in the equatorial region, specifically in the eastern and central Pacific. It affects weather patterns worldwide in different ways and different intensities. During a typical El Niño event, the warmer ocean surface changes wind directions and maritime currents, influencing rainfall distribution and temperature patterns. Its impacts can be felt in different regions of the globe, depending on the strength and duration of the event. In some cases, it can lead to heavy rain, flooding and landslides in normally arid regions, while in others, it can cause drought and water shortages.

When it comes to South America’s power markets, El Niño events tend to influence two key variables: load, as power demand is highly correlated to temperature, and generation mix, since rainfall levels are critical in hydropower-based systems in the region. Ultimately, depending on power system conditions and the intensity of the event, El Niño can also affect power prices. Brazil, Colombia, Chile, and Peru are typically affected by the phenomenon since hydro plays a role in their power mix. El Niño tends to have a varying impact on hydropower use in South America. For instance, it can cause higher-than-average rainfall which leads to higher hydropower output. By contrast, it can also lead to lower-than-average rainfall levels in some areas which reduces hydropower output and increases the need for thermal dispatch, pushing up spot power prices. In Colombia, for instance, where El Niño is typically associated with drought, the last mild event in 2019 resulted in water inflow levels being 14% lower than average. In Peru, however, higher precipitation levels associated with the 2019 event caused floods with water inflow levels ending up being 10% higher than average.

Colombia is very sensitive to El Niño as it is usually associated with warmer temperatures (2°C to 3°C higher than average) and prolonged drought, especially in the Caribbean (north) and Andean (central) regions of the country. Such a combination results in higher power demand and lower hydropower availability in Colombia during the second and third quarters of the year, when it is the wet season in those regions. Since power consumption growth is more sensitive to economic growth and tariffs than it is to temperature, the effects of the upcoming El Niño on power demand are likely to be suppressed by the modest economic growth of around 1% per year which is expected for Colombia in the coming few years. However, its effects on the power supply side will be more significant.

Assuming inflows are 10% lower than average through 2024, this would represent a 6.7 TWh reduction in inflow energy, leading to lower hydro storage and output, elevating the requirements for thermal dispatch. Under this scenario, and considering the current fuel price environment, gas-fired generation would increase its role at the system’s margin, pushing up currently high prices even further. As of July, this year, Colombia’s spot prices averaged $96 per megawatt-hour (MWh), 91% up on the same period last year ($50/MWh). If fuel prices remain at similar levels and hydro generation falls due to lower rainfall levels, Colombia’s spot power prices would average above $100/MWh over 1H 2024, depending on the duration and real intensity of the El Niño event. While multiple variables make it challenging to isolate the effects of El Niño on Colombia’s power prices, the event is usually associated with higher prices, as can be seen through 2015-16, when a strong event took place, and over 2018-19 when a weaker event happened.

Source: Rystad Energy Renewables & Power Solution

Shell’s Barreirinhas block exits pile pressure on Brazil’s exploration sector

Brazil’s offshore exploration sector has been dealt another significant blow following Shell’s decision, revealed two weeks ago, to relinquish a quartet of blocks in the Barreirinhas Basin. The UK-based major’s move follows the withdrawal earlier this decade by European peers TotalEnergies and BP from tracts in the nearby Foz do Amazonas Basin, where state oil giant Petrobras remains in a tussle with environmental regulators over its own drilling plans. Although Shell has decided to hold on to six other blocks in the Barreirinhas Basin, environmental concerns and regulatory hurdles threaten any potential further exploration in this prospective region off Brazil’s northern coast.

Sedimentary basins within the Brazilian equatorial margin are believed to be resource rich and have in the past attracted prominent explorers, with the prospect of hitting substantial volumes magnified by a flurry of successes in the conjugate Guyana-Suriname Basin. Petrobras is, however, struggling to progress exploration drilling at its high-impact Morpho well in the nearby Foz do Amazonas Basin, with clearance so far withheld by the Brazilian Institute of Environment & Renewable Natural Resources (IBAMA). The difficulty in obtaining environmental clearance for drilling in the area has meant Brazil has found it hard to attract international explorers to the region in recent years. Shell cited technical reasons for its decision to quit the four Barreirinhas Basin blocks.

Shell inherited 10 exploration blocks in the Barreirinhas Basin through its acquisition of BG Group in 2016. These include the now relinquished BAR-M-215, BAR-M-217, BAR-M-252 and BAR-M-254 blocks along with BAR-M-298, BAR-M-300, BAR-M-340, BAR-M-342, BAR-M-344 and BAR-M-388. Among the six blocks retained, Shell holds a 100% interest in each of BAR-M-298 and BAR-M-340 and a 50% operated interest in each of BAR-M-300, BAR-M-342, BAR-M-344 and BAR-M-388, where it is joined by Petrobras on 40% and Portuguese independent Galp Energia on 10%. These last four blocks commanded a cumulative 251 million Brazilian reais ($51.23 million on current exchange rates) in bonuses when they were awarded in 2013 as part of the country’s 11th Licensing Round.

Technical reasons have been cited for the relinquishment of blocks, however the difficulty of obtaining a green light for exploration drilling cannot be overlooked. It opens the possibility of a complete abandonment of blocks in the area by international explorers, leaving the onus on Petrobras to continue its tussle with IBAMA to secure drilling rights, as has been the case in the adjoining Foz do Amazonas Basin following the walkouts of French major TotalEnergies and UK peer BP in 2020.

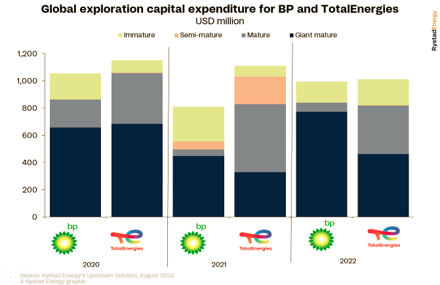

Of the remaining active blocks in the Barreirinhas Basin, BP (operator) and TotalEnergies hold an equal participating interest in Block BAR-M-346. Although both majors have shown an appetite to continue exploring in the basin in recent years, there has been a decreasing trend in exploration spending, with TotalEnergies’ exploration spending down 12% and BP’s 6% between 2020 and last year. Among the two, TotalEnergies has shown the greater appetite to explore in frontier blocks globally, unearthing a handful of meaningful finds in the likes of Suriname and Namibia, whereas BP’s frontier exploration has been mostly focused on North America, particularly off eastern Canada. We, therefore, do not see these two majors undertaking exploration drilling in the Barreirinhas Basin any time soon. Three of the remaining active blocks in the basin are held by UK-based Chariot Limited and one by Brazilian independent 3R Petroleum with 100% participating interests, both of which could also be considered unlikely to undertake exploration drilling in this high-risk area.

Despite uncertainties over the prospectivity of the Barreirinhas Basin, Petrobras intends to continue its exploration drive and hopes to unearth a substantial discovery capable of being commercially developed. The company’s ambition was somewhat stymied by IBAMA’s decision to ban exploration drilling off the mouth of Amazon River, citing technical inconsistencies in Petrobras’ environmental impact assessment relating to issues ranging from spill response to consultation with coastal indigenous communities. The state giant plans, however, to appeal the decision against drilling of its Morpho-1 well in Block FZA-M-59 in the Foz do Amazonas Basin, for which the Ocyan drillship ODN II was scheduled to be mobilized by the middle of this year. Given the delay in environmental clearance, Petrobras’ ambition to begin its new exploration drive in the Barreirinhas Basin is likely to be delayed. The company plans to drill the Cumbia wildcat in BM-BAR-1 in 2,015 meters of water next year, which will help it appraise and understand the subsurface character of the earlier Alcantara gas discover while it also plans to potentially follow up with the Calliban and Cumbia Extension probes in 2025 and 2026, respectively – the latter if Cumbia proves successful. This highlights the significance of Petrobras obtaining approval from the environmental agency – failure to do so could put an end to any further exploration by any company in what has been considered a promising basin.

rystadenergy.com 08 23 2023