Myra P. Saefong, MarketWatch

SAN FRANCISCO

EnergiesNet.com 02 09 2023

Nearly a year after Russia’s invasion of Ukraine, the ongoing war has called attention to how vulnerable the U.S. petroleum market is to an event thousands of miles away, and may lead to a shift in the global market to better secure energy supplies.

Russia’s actions on Feb. 24, 2022, ignited “widespread, credible concerns of extraordinary disruptions in oil and [natural] gas flow to Europe,” says Brian Milne, product manager, editor, and analyst at DTN. Europe’s reliance on Russian natural gas had the “potential to make Europeans hostages during the winter months,” if Russian President Vladimir Putin cut off gas supply to the continent.

The U.S., meanwhile, was “far from immune to the energy price impacts” of the invasion, says Luke Tilley, chief economist at Wilmington Trust, with a less than two-week rise of about 38% in U.S. oil prices hitting U.S. consumers at the pump, contributing to “overall inflation directly via gasoline prices, but also through ripple effects for transportation costs and other materials.”

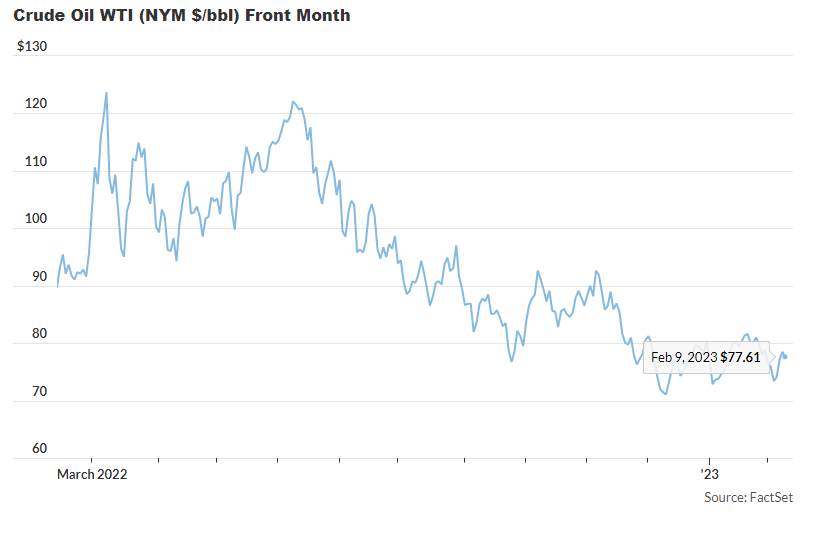

U.S. benchmark West Texas Intermediate crude CL.1, 2.55% CLH23, 2.56% rose from around $92 a barrel the day before the invasion to a high of $126.84 on March 9.

There were real disruptions from Russia’s invasion, but “extraordinary efforts by Europeans to reduce their demand following the invasion was a critical factor in waving off a devastating crisis,” Milne says. “Coolheaded negotiations” by European Union members also helped, as they moved to punish Moscow for its assault with sanctions and bought time to reroute global oil and gas flows and allow an eventual buildup in inventory.

Read: Inside Germany’s industrial-sized effort to wean itself off Putin and Russian natural gas

Tilley says there was a “small dip” of less than 1% in global petroleum supply after the Russian invasion, from March to April of 2022, which pales in comparison to the 13% drop at the onset of the Covid-19 pandemic in 2020.

“Some trade partners were quite willing to purchase from Russia and that, combined with sanction dodging on a massive scale, kept petroleum flowing,” says Tilley. As of Feb. 8, WTI crude has dropped 38% from its peak price last year.

“There’s more certainty now nearly a year into the war, although still less certainty than if the war had never happened,” says Patrick De Haan, head of petroleum analysis at GasBuddy. “The instability comes and goes, and the flows of oil have gotten more creative to navigate the complex web of sanctions.”

The European Union banned imports of seaborne Russian oil and oil products and, together with the Group of Seven, adopted price caps for seaborne Russian oil and oil products.

Read: The EU’s latest embargo on Russia will keep diesel prices high

There’s been a “muted response” to oil-related sanctions on Russia, but U.S. refiners will benefit as Russia loses customers and its oil production declines in the short term, says DTN’s Milne.

He believes the war in Ukraine has “led to a new era in global energy markets and will continue to change the dynamic in U.S. oil and fuel markets.”

“Strong foreign demand for U.S. crude…will direct crude flow to Texas ports such as Corpus Christi for export,” he says. This trend will continue as Russian crude exports and production decline amid “sanctions and the refusal of most EU countries to import oil from Russia.”

The effects of Russia’s invasion of Ukraine, meanwhile, have also lowered world GDP growth in the short term, slowing demand growth for oil, natural gas, and diesel. At the same time, Moscow’s “flaunting of international law with the invasion has also led to heightened concern over energy security,” said Milne.

That will “drive countries to source more closely to home, instead of searching for the cheapest energy molecule, with Russia’s aggression having upended global trade flows developed in recent decades,” he said.

marketwatch 02 09 2023