- Petrobras chief Prates will ‘have to keep the ball rolling’ or see oil boom fade.

Will Kennedy, Bloomberg News

LONDON

EnergiesNet.com 03 27 2023

Oil’s had a tough start to the year, but the reason many traders see a stronger market ahead is a lack of new supply.

Major producers are keeping a lid on capex, and the recent turbulence in the banking sector may serve to restrict capital even more, curbing growth in areas such as the US shale patch.

But further south, Brazil looks like it’s bucking the trend. Latin America’s largest producer is slated to add about 300,000 barrels a day this year — almost a quarter of the likely global increase — as five new platforms arrive to drill the country’s prolific offshore fields.

The US shale industry justifiably takes the plaudits for keeping the world supplied over the past decade, but Brazil has been another powerhouse: Production is set to hit a record 3.4 million barrels a day this year from just over 1 million a day at the start of the century.

Output will keep rising for a few years yet and is forecast to reach 4.6 million barrels a day in 2030. Then decline takes over. Put simply, Brazil, which hasn’t had a really significant discovery for a decade, needs to find more oil fast if it’s going to maintain its clout.

Geologists believe there could be lots of oil off the northernmost part of the country. It’s the same play as Guyana, where Exxon Mobil Corp. is developing giant new fields.

Will Brazil go for it? President Luiz Inacio Lula da Silva, in post for a third term, has always backed the oil industry as an engine of economic growth. But he’s also positioned himself as an environmental champion. An emergency tax on oil exports to close a hole in the budget has alarmed the industry.

In an interview yesterday, Jean Paul Prates, the Lula-appointed boss of state-controlled oil producer Petrobras, was clear that he’ll focus on exploration and production.

“We came out very late to this game as a big producer, but we have to keep the ball rolling,” he said.

Brazil will need to push hard or confront the end of its oil boom.

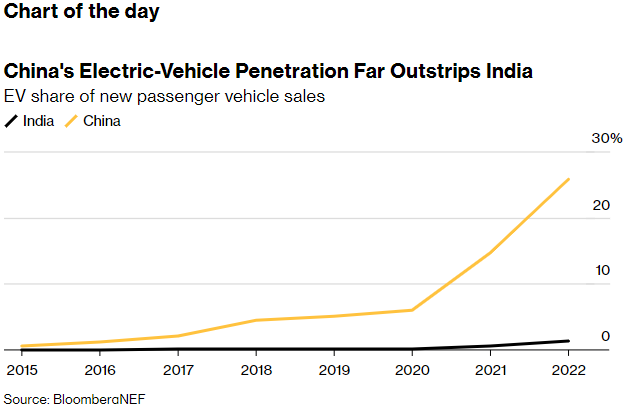

A change is on the horizon for oil consumption, with India set to eclipse China as the most important driver of global growth — and potentially the last, as the world shifts to a greener future. A swelling population will help underpin that growth along with trends in demand. India’s transition from traditional gasoline and diesel-fueled transport is expected to lag behind other regions, whereas China’s adoption of electric vehicles is skyrocketing.

Top stories

European companies are using more natural gas as prices drop to prewar levels, potentially straining preparations for another winter with limited Russian supply. The shift is mainly evident in the refining industry, which can switch more easily between raw materials ranging from gas to fuel oil.

UK agriculture has scoured the globe to fill the void of migrant labor since Brexit while still trying to supply supermarkets used to wholesale prices that barely cover costs. Keeping the shelves stocked is becoming a precarious — and murky — business for farmers and vulnerable workers.

President Joe Biden’s administration is stepping up a campaign to build American influence in Africa, where the US has lost ground to key rivals. The push comes amid a race to secure minerals that are critical to green energy, with Africa holding some of the world’s biggest supplies.

The Canada Pension Plan Investment Board is exploring buying the shares of ReNew Energy Global Plc that it doesn’t already own and taking the Nasdaq-listed firm private, people with knowledge of the matter said.

South Pole, the world’s leading purveyor of carbon offsets, is facing allegations that it exaggerated climate claims around its forest-protection projects. The uncertainty could influence how legions of companies try to slash their emissions.

Best of the rest

- The European Union wants to make solar its single biggest source of energy by 2030, but the bloc’s panel imports are dominated by China. The Net Zero Industry Act calls for the EU to produce at least 40% of its clean-tech needs within its own borders, but that may be unrealistic, according to the Financial Times.

- Gene-edited food can now be developed commercially in England due to a new law. Supporters say it will hasten the development of hardier crops needed amid climate change. Critics say it could bring “disaster” to food production and the environment. The BBC studies the pros and cons.

- The Center for Strategic and International Studies looks at proposed methane regulations in the oil and gas industry both in the US and the EU — rules that are set to play a critical role in curbing emissions.

— With assistance by Yongchang Chin

bloomberg.com 03 24 2023