- A flood of LNG supply deals is giving the world’s No. 2 economy more influence in the fastest-growing fossil fuel market.

Stephen Stapczynski, Bloomberg News

SINGAPORE

Energiesnet.com 07 14 2023

“Energy security” has become a trendy phrase to explain many countries’ plans for building up fuel supplies. And it’s certainly a big reason behind China’s spending spree to procure natural gas for well into the future.

But there’s more to the nation’s strategy: The unrelenting pace of supply deals is bolstering the influence of the world’s second-largest economy in the fastest-growing fossil fuel market.

For the third straight year, Chinese companies are agreeing to buy more liquefied natural gas on a long-term basis than any single nation. Importers are consistently signing some of the industry’s longest and largest contracts, and the government is happy if they ink more.

These deals lock in LNG through the middle of the century to help avoid energy shortages — like the ones the country faced in recent years due to coal and hydropower supply crunches. At the same time, the push expands China’s control over global gas supply.

You could see that second point in full swing last year. The country’s LNG buyers turned into suppliers, playing a key role in balancing the market by reselling spot shipments to European importers rushing to replace pipeline gas from Russia.

China began its drive for long-term contracts in 2021 after relations with the US improved. While imports dipped last year partly due to weaker demand amid Covid restrictions, Chinese buyers renewed the effort after Russia’s invasion of Ukraine cut pipeline gas to Europe.

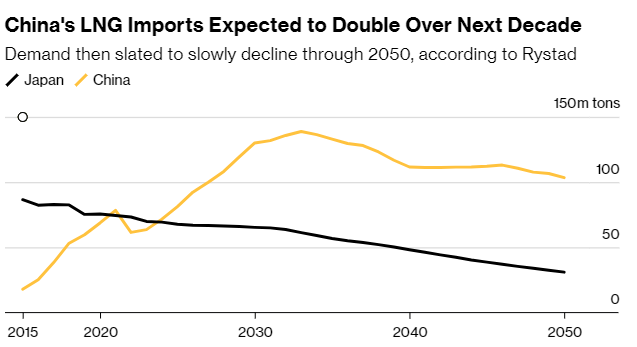

This is China’s go-to strategy when it comes to energy and commodities. From copper to rare earths, it tries to expand influence over the stuff that’s vital to both the nation’s economy and the world’s. The country is on track to be the top importer of LNG in 2023, with demand set to roughly double over the next decade.

The LNG drive gives the nation a seat at the table for the global seaborne trade of gas, even though it’s not an exporter. Plus, suppliers are eager to court Chinese buyers since no other importer will promise to buy gas for nearly 30 years.

The upshot: China can provide stability during periods of global shortages, but it could withhold supply and drive up prices if needs at home must be met. Either way, the nation will be shaping the future of the industry for decades to come.

–Stephen Stapczynski, Senior Energy Reporter

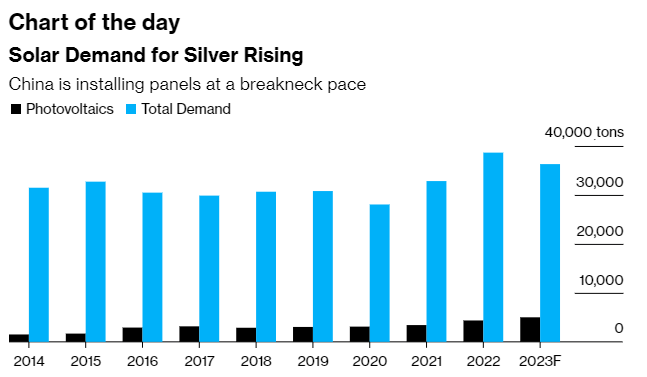

Figures for 2023 are a forecast.

China is installing panels at a breakneck pacehttps://www.bloomberg.com/toaster/v2/charts/8414e80c91728355b22e7e34a93e73d8.html?brand=markets&webTheme=markets&web=true&hideTitles=true

Changes to solar-panel technology are accelerating demand for silver, a phenomenon that’s widening a supply deficit for a metal with little additional mine production on the horizon. Solar’s part of overall silver demand is forecast to make up 14% of consumption this year, compared with about 5% in 2014.

bloomberg.com 07 10 2023