Watch video: Oil Market to Return to Surplus in 2022, ING Says

– Japan, South Korea and India may make joint announcements

– Move could heighten confrontation with OPEC+ nations

By Annmarie Hordern, Ari Natter, and Jennifer A Dlouhy / Bloomberg

WASHINGTON

Petroleumworld 11 23 2021

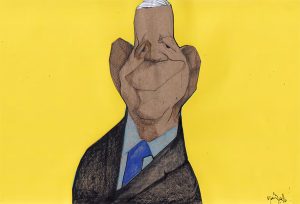

President Joe Biden is preparing to announce a release of oil from the nation’s Strategic Petroleum Reserve in concert with several other countries as soon as Tuesday, according to people familiar with the plan.

The move, likely in conjunction with India, Japan and South Korea, would be an unprecedented effort by major oil consumers to tame prices after OPEC+ countries rebuffed U.S. calls to significantly boost production. China said it’s working to release some oil from its strategic reserves, days after the U.S. invited it to participate in a joint sale.

The situation remains in flux and the plans could change but the U.S. is considering a release of more than 35 million barrels over time, according to two of the people. The pending announcement was described by people who requested anonymity prior to official statements.

The move would pit the countries against the OPEC+ coalition — led by Saudi Arabia and Russia — for control over world oil markets and could prompt OPEC and its allies to re-evaluate plans for reviving oil supplies.

International Energy Forum Secretary-General Joseph McMonigle said in a statement Monday that OPEC+ may change its plan for raising oil output if consuming nations sell petroleum reserves or the coronavirus pandemic worsens.

“Such a move would potentially raise the stakes in the oil poker game and could produce new strains in the bilateral relationship between Washington and Riyadh,” said Helima Croft, chief commodities strategist at RBC Capital Markets LLC.

Representatives of the U.S. Energy Department didn’t respond to a request for comment. White House Press Secretary Jen Psaki said the U.S. has been in contact with other countries but declined to say how the administration plans to proceed.

“We have been having conversations with a range of countries about the importance of making sure that the supply out there meets the demand and helps prevent an imperiling of the global economic recovery,” Psaki told reporters on Monday. “I don’t have anything to preview for you today.”

Indian government officials with knowledge of the plans said Monday that the nation has yet to decide on timing and volume of releasing emergency oil stocks but that it will be a coordinated step with other major consumers such as Japan and China.

Japan’s TV Asahi reported Monday that Tokyo is preparing to release crude from its national stockpiles. Japanese Prime Minister Fumio Kishida had said his government was considering a release from reserves in coordination with countries such as the U.S.

“The Strategic Petroleum Reserve — that is available to be released in times of national emergency and when the president thinks that it might need to be done,” Heather Boushey, a member of the White House Council of Economic Advisers, said Monday in an interview on Bloomberg Televison’s “Balance of Power With David Westin.”

Oil futures rose 81 cents to settle at $76.75 a barrel in New York after earlier rising to as high as $77.16. Oil has fallen from a high in late October as speculation increased that the U.S. and other countries would release reserves.

Biden has been seeking the joint release for weeks, including during a virtual summit with Chinese President Xi Jinping.

The move would represent the largest privately arranged discharge of stockpiled crude from major economies. Previous global efforts to tap stockpiles — such as the 2011 release of 60 million barrels in the wake of unrest and supply disruptions in Libya — were coordinated by the International Energy Agency.

Biden has been under increasing pressure to stem rising energy prices that threaten to undermine the economic recovery from the pandemic. OPEC+ earlier snubbed his request for a large production increase and instead raised output by just 400,000 barrels per day for December.

The White House announced Biden will give a speech on the economy and combating inflation on Tuesday.

The national average price for a gallon of regular unleaded gasoline has been hovering around a seven-year high and was $3.409 as of Nov. 21, according to auto club AAA.

The Organization of Petroleum Exporting Countries and its allies will meet on Dec. 2 to contemplate an increase of production by 400,000 barrels a day in January.

_____________

By Annmarie Hordern, Ari Natter, and Jennifer A Dlouh from Bloomberg News

bloomberg.com 11 21 2021

Copyright ©1999-2021 Petroleumworld or respective author or news agency. All rights reserved.

Petroleumworld.com Copyright ©2021 Petroleumworld.