Causes

An unusual coalition is joining the United States in releasing their stockpiles, including China,

India, Japan, South Korea and Britain

By John Biers / AFP

NEW YORK

Petroleumworld 11 24 2021

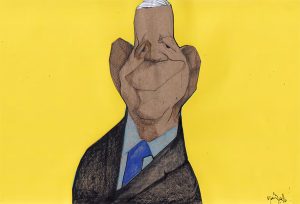

President Joe Biden is tapping the US strategic oil reserve in an effort to lower gasoline prices, but crude actually rose in Tuesday’s trading while analysts warned that there is no guarantee the reserves will make a difference.

As his administration battles a surge in inflation amid the holiday season, Biden announced he would open the spigot on 50 million barrels from the Strategic Petroleum Reserve to cut prices at pumps across the world’s largest economy.

An unusual coalition is joining the United States in releasing their stockpiles, including China, India, Japan, South Korea and Britain.

One analyst said the grouping amounted to the «official emergence of an ‘anti-OPEC+,'» referring to the bloc of global petroleum producers.

The announcement was not enough to stop energy prices from climbing. West Texas Intermediate oil futures closed New York trading 2.2 percent higher at $78.50.

Market watchers cautioned against making too much of Tuesday’s rally in oil prices, noting that crude had already pulled back in anticipation of the administration’s action.

The gains in oil prices also reflect doubts about whether Biden’s move will appreciably shift the supply-demand interplay in a global crude market that has tightened in recent months as the economic recovery has accelerated, analysts said.

«It’s symbolic because it’s very difficult for the administration to do anything to lower gas prices unless you increase the supply in a meaningful way,» said Andy Lipow of Lipow Oil Associates in Houston.

– The OPEC unknown –

Others members of the six countries involved in the release have not announced details, but they are expected to release far lower amounts than the United States.

Analysts noted that the amount of oil involved — perhaps 70 million barrels in total — is relatively paltry in a global market that consumes close to 100 million barrels a day.

Another unknown is how the OPEC+ coalition of oil exporters led by Saudi Arabia will react to the statement. The group said earlier this month it planned to boost output by 400,000 barrels per-day in December.

Biden’s announcement «increases the probability that they will delay that,» said James Williams of WTRG Economics, adding that the group could also scale back plans to lift oil production in January.

The coalition behind Tuesday’s release differs from past alliances in some significant ways, analysts said.

Releases from strategic stockpiles are normally coordinated by the International Energy Agency (IEA) in Paris, of which leading European nations are members.

Of the six countries involved in the release of reserves, the United States, Japan, South Korea and Britain are all IEA members, while China and India are listed on the organization’s website as «association countries.»

The IEA acknowledged the Washington-led action, saying in a statement it recognized that higher oil prices have «added to inflationary pressures during a period when the economic recovery remains uneven and faces a range of risks.»

– ‘Supply poker game’ –

Mark Finley, a fellow at the Baker Institute at Rice University in Houston, said the IEA’s apparent non-involvement was «striking» and suggests a break between the European Union and other consuming regions over energy.

«Where are Europe’s IEA members in the chatter about a coordinated strategic stock release?» Finley asked on Twitter.

«Are they less scared by rising fuel prices (with higher taxes)? More focused on climate change and reducing fossil fuel use? What does it mean for IEA cooperation going forward?»

John Kilduff, a partner at Again Capital, said the new alliance indicated that consuming nations are «getting their act together» in response to higher oil prices.

«OPEC will have a heightened sensitivity to the plight of the consuming nations,» Kilduff said.

But Rystad Energy oil market analyst Bjornar Tonhaugen said the proof will be in the outcome of the OPEC+ meeting next week.

«The coming OPEC+ meeting is to be watched closely as it could offer an interesting supply poker game ahead,» he said.

«If the move is seen as aggressive by OPEC+, the group could in theory even cut back supply into January to maintain its profits.»

______________________________________

By Agence France-Presse.

afp.com 11 23 2021

Copyright ©1999-2021 Petroleumworld or respective author or news agency. All rights reserved.

Petroleumworld.com Copyright ©2021 Petroleumworld.