By Isis Almeida and Vanessa Dezem/Bloomberg

LONDON/FRANKFURT

EnergiesNet.com 12 29 2021

Don’t let the recent meltdown in European natural gas prices fool you. The energy crunch of 2021 will last for years.

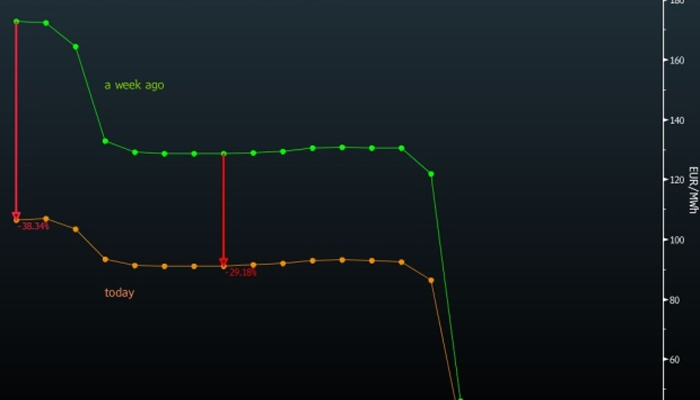

That’s what futures traders are betting on, with spot prices dropping a lot more than forward contracts over the past week. The scale of the moves signal the flotilla of liquefied natural gas cargoes heading to Europe will only provide short-term relief, and prices will still be expensive all the way to March 2023.

Europe is facing an energy crisis, with Russia curbing supplies and nuclear outages in France straining power grids in the coldest months of the year. While more cargoes are landing in Europe for now, the fate of the market is still hanging on the approval of the controversial Nord Stream 2 pipeline, which President Vladimir Putin says could help cool this year’s 400% rally.

“Europe’s gas problem may not go away next year,” Andrew Hill, head of European gas analysis at BloombergNEF, said in a report on Wednesday. “Geopolitical issues and acrimony with Russia, particularly around the Nord Stream 2 pipeline, will increase the scope for Russia to limit flows to Europe in the first half of the year, and potentially much longer.”

Spot gas prices fell almost 40% over the past week, while losses for forward contracts were capped at about 30%.

By Isis Almeida and Vanessa Dezem from Bloomberg

bloomberg.com 12 29 2021

Dear Readers, We apologize that the English Home page is offline due to a technical problem that we are still resolving.

Dear Readers, We apologize that the English Home page is offline due to a technical problem that we are still resolving.