By Reuters

HOUSTON

EnergiesNet.com 12 22 2021

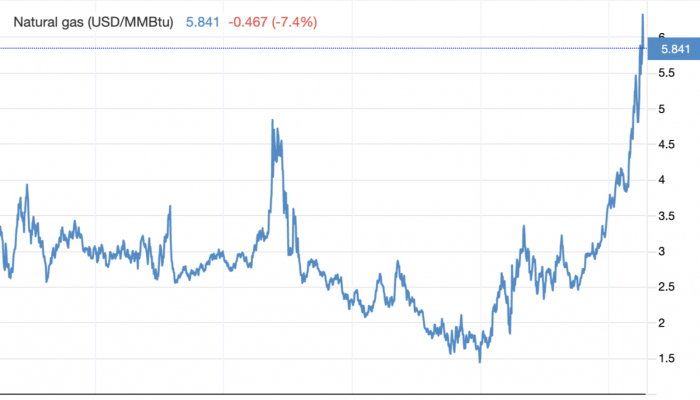

U.S. natural gas futures edged up on Tuesday, shrugging off forecasts for milder weather and lower heating demand next week than previously expected, and focusing instead on a sharp rally in European gas futures that could keep U.S. liquefied natural gas exports near record highs.

Front-month gas futures rose 3.5 cents, or 0.9%, to settle at $3.869 per million British thermal units (mmBtu), after rising nearly 4% in the previous session.

«We are in push-pull market condition. On the one hand, we are currently seeing record high LNG feedgas, caused by the high prices in Europe and Asia, as well as the expansion at Sabine Pass. On the other hand, both the GFS00 and EC00 weather models have shifted warmer over the next two weeks,» Refinitiv analyst John Abeln said.

Gas prices in Europe jumped to an all-time high as Russian gas shipments to Germany through a major transit pipeline reversed direction and colder weather increased demand.

No matter how high global gas prices rise, the United States can only convert about 11.1 bcfd of gas into LNG. The rest of the gas flowing to the export plants is used to fuel equipment that produces the it.

«Curtailed Russian flows into Europe will not necessarily be equating to an incremental increase in LNG exports given capacity considerations. So, until some bullish assistance is provided by the weather factor, the gas market will continue to experience some difficulty in pushing above the $4.00-4.10 zone,» advisory firm Ritterbusch and Associates said in a note.

Data provider Refinitiv projected average U.S. gas demand, including exports, would fall from 123.7 cubic feet per day this week to 118.6 bcfd next week as the weather turns milder.

Refinitiv estimated 405 heating degree days (HDDs) over the next two weeks in the lower 48 U.S. states, down from the 413 HDDs estimated on Monday. The normal is 428 HDDs for this time of year.

HDDs, used to estimate demand to heat homes and businesses, measure the number of degrees a day’s average temperature is below 65 Fahrenheit (18 Celsius).

Mostly mild weather since mid-November has kept heating demand low and means there will soon be more gas in stockpiles than is usual for the time of year for the first time since April.

The amount of gas flowing to U.S. LNG export plants has averaged 11.9 bcfd so far in December, now that the sixth train at Cheniere Energy Inc’s (LNG.A) Sabine Pass plant in Louisiana is producing LNG. That compares to 11.4 bcfd in November and a monthly record of 11.5 bcfd in April.

Output in the U.S. Lower 48 states has averaged 96.7 billion cubic feet per day (bcfd) so far in December, which would top the monthly record of 96.5 bcfd in November.

| Week ended Dec 17 (Forecast) | Week ended Dec 10 (Actual) | Year ago Dec 17 | Five-year average Dec 17 | ||

| U.S. weekly natgas storage change (bcf): | -64 | -88 | -147 | -153 | |

| U.S. total natgas in storage (bcf): | 3,353 | 3,417 | 3,496 | 3,328 | |

| U.S. total storage versus 5-year average | +0.8 | -1.8% | |||

| Global Gas Benchmark Futures ($ per mmBtu) | Current Day | Prior Day | This Month Last Year | Prior Year Average 2020 | Five Year Average (2016-2020) |

| Henry Hub | 3.85 | 3.70 | 2.58 | 2.13 | 2.66 |

| Title Transfer Facility (TTF) | 57.91 | 47.24 | 5.82 | 3.24 | 5.19 |

| Japan Korea Marker (JKM) | — | 43.45 | 9.46 | 4.22 | 6.49 |

| Refinitiv Heating (HDD), Cooling (CDD) and Total (TDD) Degree Days | |||||

| Two-Week Total Forecast | Current Day | Prior Day | Prior Year | 10-Year Norm | 30-Year Norm |

| U.S. GFS HDDs | 405 | 413 | 374 | 407 | 428 |

| U.S. GFS CDDs | 8 | 9 | 3 | 4 | 4 |

| U.S. GFS TDDs | 413 | 422 | 378 | 411 | 432 |

| Refinitiv U.S. Weekly GFS Supply and Demand Forecasts | |||||

| Prior Week | Current Week | Next Week | This Week Last Year | Five-Year Average For Month | |

| U.S. Supply (bcfd) | |||||

| U.S. Lower 48 Dry Production | 96.8 | 97.1 | 97.3 | 92.1 | 84.7 |

| U.S. Imports from Canada | 8.0 | 8.5 | 9.1 | 9.2 | 8.9 |

| U.S. LNG Imports | 0.0 | 0.0 | 0.0 | 0.1 | 0.3 |

| Total U.S. Supply | 104.9 | 105.6 | 106.3 | 101.4 | 93.9 |

| U.S. Demand (bcfd) | |||||

| U.S. Exports to Canada | 3.7 | 3.6 | 3.6 | 2.9 | 3.0 |

| U.S. Exports to Mexico | 5.4 | 5.4 | 5.5 | 4.9 | 4.6 |

| U.S. LNG Exports | 11.9 | 12.8 | 12.7 | 11.0 | 5.0 |

| U.S. Commercial | 12.5 | 15.6 | 15.3 | 16.2 | 15.0 |

| U.S. Residential | 20.1 | 26.0 | 25.5 | 27.1 | 25.4 |

| U.S. Power Plant | 25.6 | 28.1 | 24.7 | 26.3 | 25.8 |

| U.S. Industrial | 23.2 | 24.6 | 23.8 | 25.1 | 24.6 |

| U.S. Plant Fuel | 4.8 | 4.8 | 4.8 | 4.8 | 4.8 |

| U.S. Pipe Distribution | 2.4 | 2.7 | 2.6 | 2.4 | 2.4 |

| U.S. Vehicle Fuel | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 |

| Total U.S. Consumption | 88.7 | 101.9 | 96.7 | 102.0 | 98.1 |

| Total U.S. Demand | 109.7 | 123.7 | 118.6 | 120.8 | 110.7 |

| U.S. weekly power generation percent by fuel – EIA | |||||

| Week ended Dec 24 | Week ended Dec 17 | Week ended Dec 10 | Week ended Dec 3 | Week ended Nov 26 | |

| Wind | 12 | 15 | 13 | 11 | 13 |

| Solar | 2 | 2 | 2 | 2 | 2 |

| Hydro | 7 | 7 | 7 | 6 | 6 |

| Other | 2 | 2 | 2 | 2 | 2 |

| Petroleum | 1 | 1 | 1 | 1 | 1 |

| Natural Gas | 34 | 34 | 36 | 37 | 34 |

| Coal | 19 | 18 | 19 | 19 | 20 |

| Nuclear | 23 | 22 | 21 | 22 | 22 |

| SNL U.S. Natural Gas Next-Day Prices ($ per mmBtu) | |||||

| Hub | Current Day | Prior Day | |||

| Henry Hub | 3.91 | 3.71 | |||

| Transco Z6 New York | 3.82 | 3.99 | |||

| PG&E Citygate | 6.50 | 5.56 | |||

| Dominion South | 3.25 | 2.99 | |||

| Chicago Citygate | 3.71 | 3.49 | |||

| Algonquin Citygate | 7.59 | 19.61 | |||

| SoCal Citygate | 8.81 | 7.05 | |||

| Waha Hub | 3.69 | 3.42 | |||

| AECO | 4.0 | 3.87 | |||

| SNL U.S. Power Next-Day Prices ($ per megawatt-hour) | |||||

| Hub | Current Day | Prior Day | |||

| New England | 92.25 | 107.50 | |||

| PJM West | 34.00 | 28.50 | |||

| Ercot North | 39.00 | 26.75 | |||

| Mid C | 64.33 | 51.50 | |||

| Palo Verde | 72.75 | 48.25 | |||

| SP-15 | 74.25 | 56.25 |

Reporting by Brijesh Patel in Bengaluru; editing by Barbara Lewis and Jonathan Oatis from Reuters

EnergiesNet.com 12 22 2021