Kiana Wilburg, Kaieteur News

GEORGETOWN

Energiesnet.com 03 20 2023

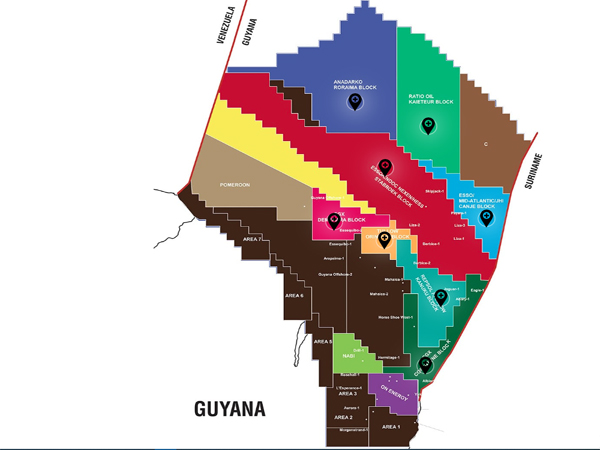

The Guyana Government released yesterday, two drafts of new Model Production Sharing Agreements (PSAs), one of which will govern shallow water blocks while the other will apply to deep water concessions. Citizens now have two weeks to peruse the documents that will feature in the upcoming licensing round for the 14 oil blocks.

When compared to the controversial Stabroek Block Production Sharing Agreement (PSA), signed with an ExxonMobil-led consortium in 2016, it is clear that the government made deliberate efforts to close several dangerous loopholes for abuse and revenue leakage.

A significant feature in the new draft agreements is that the government has preserved the right to review and approve the budgets for the exploration and development programmes of the oil companies. The agreements state that: “The contractor shall submit to the minister for approval, in accordance with the Accounting Procedures, a Budget of the Costs to be incurred in implementation of each Work Programme, simultaneously with the submission of such Work Programmes. The minister will decide on the proposal of Budgets simultaneously with the approval of the corresponding Work Programme.” Such powers are not enshrined in the Stabroek Block PSA or any other existing PSA.

Equally important is the insertion of a new provision that ensures the country is not left on the hook for any of the oil companies’ bills. That clause speaks to indemnification. At Article 30.2 it says: “The contractor shall indemnify, defend, and hold the minister and Government of Guyana harmless against all claims, losses and damages of any nature whatsoever by any personnel of the contractor or of any subcontractor for the loss or damage to personal property or injury or death to Persons caused by or resulting from any petroleum operations conducted by or on behalf of the contractor under this Agreement or any License issued pursuant to the Act.”

On the issue of insurance, the draft contracts state that the oil companies must have in place, policies that cover pollution caused in the course of petroleum operations for which the contractor may be held responsible. The agreements also state that, “At the minister’s discretion the contractor may be permitted to self-insure all or part of the aforementioned insurances.” The ability of oil companies to self-insure, that is, to rely on their own fiscal resources, is also part of the Stabroek Block PSA and was highly criticized for years.

A new arrangement or demand rather, is that oil companies must also ensure their subcontractors have adequate insurance coverage too.

Importantly, the draft agreements state that oil companies will not be allowed to acquire the blocks and sit on their hands for decades. The draft documents categorically state that, “If in any phase of the Exploration Period, the contractor does not fulfill its obligations in respect of the Minimum Exploration Work Programme for that exploration period, the contractor is obliged to pay the Government an amount equal to the difference between the minimum expenditure obligation specified for that phase of the exploration period and the actual amounts expended on the work commitments carried out.” In the Stabroek Block PSA or in other existing agreements, no such penalty is in place.

In terms of the field development plans for a commercial discovery, the documents outline a stringent suite of international best practices that must be followed during the preparation of the document. These guidelines are now public- a stark contrast to what was obtained before, thereby increasing the level of transparency on such plans.

Unlike what obtains in the Stabroek Block PSA, the new draft agreements stipulate that the “contractor, affiliated companies, subcontractors and individuals who are expatriates shall be subject to the income tax laws of Guyana, including, the Income Tax Act of Guyana (Cap. 81:01) and the Corporation Tax Act of Guyana (Cap. 81:03) and shall separately comply with the requirements of those laws, in particular with respect to filing returns, assessment of tax, and keeping and showing of books and records.”

The new agreements also state that each expatriate employee of the contractor (including any Affiliated Company) and of subcontractors, who have been assigned to work in Guyana for the contractor or its subcontractors shall be permitted, subject to the limitations and conditions set out in the Customs Act, to import into Guyana free of import duty and taxes within six (6) months on first arrival, his personal and household effects including one (1) motor vehicle. It also states that no property so imported by the employee shall be sold by him in Guyana except in accordance with Government regulations and upon the payment of the prescribed customs duties. In the Stabroek Block PSA, expats have free reign to import free of duty.

Another significant feature of the draft model PSAs is that the contractor is now required to establish an Abandonment Fund which will be overseen by Guyanese authorities. That account will see deposits made by the oil companies as agreed by the minister. Kaieteur News understands that the minister may access funds from the account in the event that contractor fails to effect environmental clean-up during the term of this Agreement, or fails to properly abandon wells or abandon facilities to the satisfaction of minister upon termination of this Agreement. This feature is also a controversial one that was not catered for in the highly criticized Stabroek Block PSA.

But perhaps the most critical change pertains to the Stabilization Clause. According to the draft documents, this provision ensures that the agreement and the economic provisions therein, are insulated from capricious changes unless there is mutual consent. Be that as it may, the draft agreement states, “The contractor shall be subject to and must observe the laws of the Cooperative Republic of Guyana in force from time to time and nothing herein contained shall be construed as exempting the contractor from complying with the laws imposing taxes, duties, levies, fees, royalties, charges or similar impositions or contributions which the contractor would be liable to pay or may be called upon to pay under such laws by virtue of its conduct of petroleum operations hereunder, except as provided for in Article 38. 50.3.”

It continues, “If at any time after the signing of this Agreement there is a change in the laws of the Cooperative Republic of Guyana whether through the amendment of existing laws (including the hydrocarbons law, the customs code or tax code) or the enactment of new laws or a change having the force of law in the interpretation, implementation or application thereof (whether the change is specific to the Agreement, the contractor or of general application) and such change has a materially adverse effect on the economic benefits, including those resulting from the fiscal regime provided by this Agreement, accruing to the contractor hereunder during the term of this Agreement, the parties shall negotiate in good faith to modify the terms of the agreement in order to restore the economic balance so that contractor receives the same economic benefit under the Agreement that it would have received prior to the change in law or its interpretation, application, or implementation.”

The foregoing terms complement the commercial provisions which were released last December by the People’s Progressive Party Civic (PPPC) Government. The main commercial terms include a royalty rate of 10 percent, cost recovery capped at 65 percent, and profit sharing of 50 percent.

There is also a minimum signing bonus required from the bidders of US $20 million for deep water and US $10 million for shallow water blocks.

In terms of tax, the tender provides that a corporation tax of 10 percent and a property tax of 0.75 percent will be levied on the participating entities.

It is worth noting that bidders will be required to commit at least US $1 million per year towards the employment and training of the citizens of Guyana in accordance with the Local Content Act.

In a statement to the media yesterday, the ministry said the draft Model Petroleum Agreements embodies rigorous research and analysis by the ministry’s internal team, and external consultants on all topics relevant to a modern petroleum agreement for Guyana.

The ministry said the process involved a comprehensive assessment of the current petroleum agreement and the identification of best practices relevant to every contractual aspect of a modern agreement grounded in the Guyana context.

To ensure new investments are governed by a comprehensive framework of international best practices, the ministry said there will be an overhaul of the 1986 Petroleum Act and Regulations.

Feedback on the draft model agreements should be addressed to the Minister of Natural Resources and sent to licensinground2022@petroleum.gov.gy with the Permanent Secretary copied, jmckenzie@nre.gov.gy.

kaieteurnewsonline.com 03 15 2023