The bloc is looking at LNG as a key to energy independence

like this tanker in the Mediterranean that is carrying LNG. (Baz Ratner/Reuters)

Josh Ulick, WSJ

NEW YORK

EnergiesNet.com 03 15 2022

International efforts to sanction Russia for its invasion of Ukraine have magnified a long-running dilemma for the European Union: Its attempts to wean itself from coal have left it more reliant on Moscow for natural gas. This dependence has made it reluctant to support the kind of tough sanctions on energy exports that some say are essential for thwarting Russia’s aggressions.

As part of its efforts to cut greenhouse-gas emissions, the EU has reduced its reliance on coal, the burning of which produces more carbon dioxide than oil or natural gas.

Natural gas has helped fill the gap as the supply of renewable energy, such as solar and wind, but it isn’t sufficient to fully replace the reduction in coal use. This has resulted in increased use of natural gas to generate electricity, power factories and heat homes.

Share of EU energy consumption by fuel type

Some countries, such as Germany, have also been moving to phase out nuclear power, a process that was accelerated after the 2011 Fukushima disaster in Japan. France, by contrast, maintains a robust nuclear power program, which has allowed it to be less reliant on fossil fuels.

Overall, the EU gets about 40% of its natural gas imports from Russia. Germany, the bloc’s biggest importer, relied on Russia for more than two-thirds of its natural gas in 2020. Italy, the bloc’s second biggest buyer, received almost half of its imports from Russia.

Russia’s invasion of Ukraine brought calls to punish Moscow by sanctioning its energy exports. But given the EU’s dependence on Russian natural gas, the bloc’s options have been limited.

In a sign of a growing push toward independence, however, Germany last month halted certification of the Nord Stream 2 pipeline, which was expected to double its Russian natural gas imports.

As the need to reduce reliance on Russian energy becomes more pressing, European countries have been searching for ways to enhance use of alternative sources. One of these is liquefied natural gas. LNG is regular natural gas that has been cooled to a liquid state at minus-260 degrees Fahrenheit (minus-162 degrees Celsius). In its liquid state, the fuel takes up about 600 times less volume, allowing it to be shipped efficiently to places not served by pipelines.

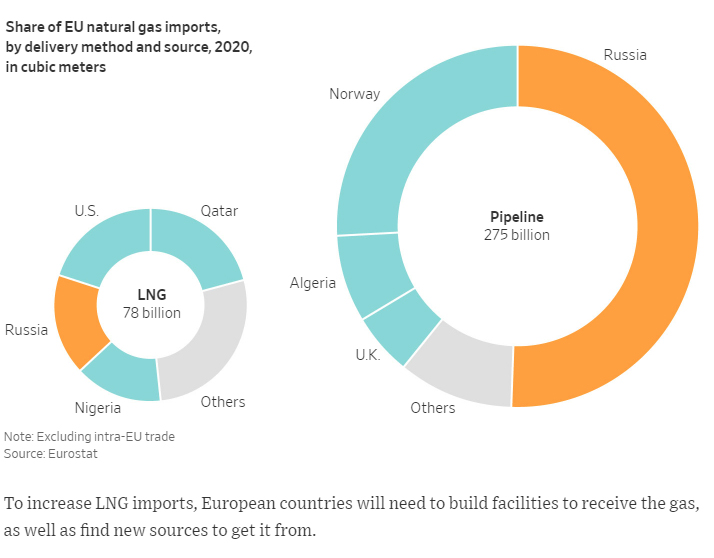

LNG accounted for about one quarter of EU gas imports in 2020, with the rest coming by pipeline. While Russia dominates pipeline trade, other countries such as the U.S. and Qatar supply larger shares of LNG.

To increase LNG imports, European countries will need to build facilities to receive the gas, as well as find new sources to get it from.

LNG requires specialized infrastructure, including plants to cool the gas, double-hulled ships to transport it and “re-gasification” facilities on the receiving end to turn the liquid back into a gaseous state. All of this technology adds to the price of LNG, which has traditionally been more expensive than regular gas.

Germany recently approved plans to build two new LNG terminals, but they could take more than three years to complete. Many of the bloc’s existing LNG terminals are maxed out.

In addition to the technical challenges of receiving LNG is the question of where it will come from. Australia, Qatar and the U.S. are the world’s biggest LNG exporters. But much of their supply now goes to Asian importers, such as China and Japan. Europe would have to compete with these countries to secure reliable supplies.

Since the start of the Ukraine crisis, Europe has had some near-term success in diverting U.S. LNG shipments to its ports. But EU countries will likely need to sign longer-term contracts for gas to lock in demand and help suppliers secure financing to build more gas-liquefaction terminals.

The U.S. has been steadily building LNG facilities since 2016, and is projected to have the world’s largest export capacity by the end of the year, according to the U.S. Energy Information Administration. Additional facilities are planned through 2025, some of which could help meet Europe’s growing LNG needs.

However Europe proceeds, given the challenges of achieving energy independence, weaning itself off Russia won’t be easy.

Josh Ulick at Josh.Ulick@wsj.com

wsj.com 03 13 2022