A special note from our SVP and Head of Latin America, W.Schreiner Parker

‘Muerte Cruzada’ may have a dramatic sounding name but in Ecuador it’s proved to be just the opposite. This month, Guillermo Lasso decided to invoke his constitutional right to dissolve the opposition controlled Ecuadorian Congress as it continued debating an impeachment process against him. The congress has been looking to ouster the right-wing former banker for some time and there are allegations of corruption, or association with corrupt actors, that have dogged Lasso from almost the beginning. To his credit, Lasso has been very open about using the ‘crossed death’ option if he thought the congress would have enough votes to impeach. Ironically, the measure itself was set up by Lasso’s ideological rival, Rafael Correa, years ago and essentially means that the president will rule by decree for up to six months until new elections for both congress and the executive can be held.

Initially it looked as if ‘crossed death’ might cause a repeat of the social unrest seen in neighboring Peru at the end of last year, when Peru’s president at the time, the now jailed Pedro Castillo, also tried to dissolve congress and rule by decree. The key difference, of course, is in Peru that move is illegal while in Ecuador ‘muerte cruzada’ is a legal mechanism enshrined in the 2008 Constitution, albeit one that has never been used. At the beginning of the month there was lots of bluster coming from the Correismo crowd and from the Confederation of Indigenous Nationalities of Ecuador (CONAIE) who stated they would begin massive protests and blockades throughout the Andean nation. But none of that materialized and it seems like both sides are content to wait for new elections, first round scheduled for August 20th, to see who will fill the vacancies until the next planned elections in mid-2025.

Lasso has recently said he does not plan to participate in the upcoming elections, and it appears as though his calculus is such that he believes he’ll accomplish more in four months ruling by decree than in four years with an opposition-controlled legislature. The opposition, for its part, believes that new elections will quickly usher them into power in both the legislative and executive branches. This could potentially even clear the way for the return of Rafael Correa, who has been ensconced in his wife’s home country of Belgium since being tried in absentia and receiving a guilty verdict and eight-year prison sentence for corruption. But neither the conviction nor the physical distance from Ecuador has stopped him from leading the Revolución Ciudadana movement, which now controls the mayorships of Ecuador’s two largest cities and had a very strong showing in local elections earlier this year.

What all this means for Ecuador and the wider region is still up for interpretation. Lasso is cutting his term in half with this move, and he’s probably understood that his ability to last to 2025 wasn’t a reality. Whether this means that the anti-incumbent wave is gathering steam across the region, or if this was an isolated incident, is also not clear. Political cycles between leftist and rightist governments are beginning to condense in the region and public pressure for change may become so strong as to see other leaders not be able to finish their terms. Petro in Colombia is currently sitting at 30% approval rating, only nine months into his mandate, and Fernandez in Argentina is so unpopular that he’s not running for re-election. Ecuador in this sense may be a test case for things to come, or it may be a unique situation that isn’t representative of wider regional trends. Either way people will be watching to understand just how effective ‘muerte cruzada’ has been.

Tudo de bom,

Sao Paulo, Brasil

May 31st, 2023

_____________________________

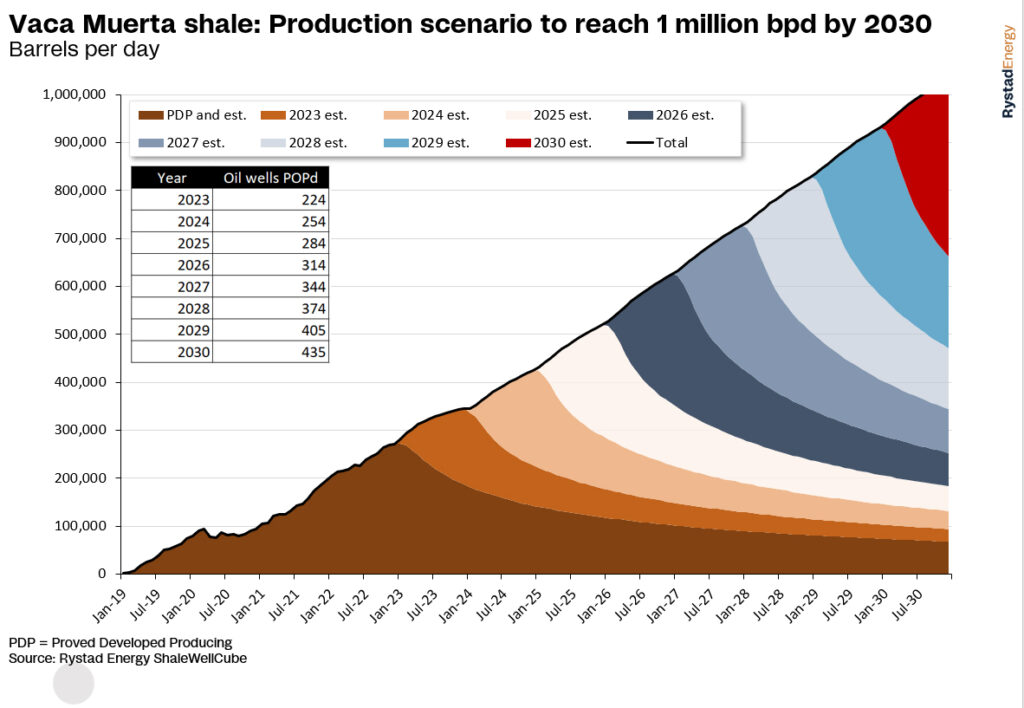

Can Vaca Muerta’s oil output reach 1 million barrels per day?

| Can Vaca Muerta’s oil output reach 1 million barrels per day? Since 2021, crude oil production from the Vaca Muerta shale play has grown by leaps and bounds, owing mostly to the collective efforts of the Argentine industry. Although these endeavors have been up to the task so far, concerns of some business segments struggling to keep pace with the rapidly expanding production rate are increasingly evident. Thus, a few questions arise: how long until the current infrastructure and service provisions in the region max out, bringing about bottlenecks and risking output growth? If the industry manages to ease these sectoral constraints while remaining resilient and adaptive, how soon could Vaca Muerta’s oil production hit 1 million barrels per day (bpd)? Hitting this important milestone will mark a change in fortune for a nation that had seen its oil production decline steadily over the past decade, allowing it to play an influential role in regional markets and trade flows, with steady growth in exports and reduced import dependence. ilProduction overview and case study As of February, Vaca Muerta’s gross oil production reached 291,000 bpd, an addition of 76,000 bpd on a yearly basis. Production from majors – Shell, Chevron, ExxonMobil, and TotalEnergies – increased by 62% in 2022 compared to 2021, followed by other local and international players and YPF, the nation’s state-run giant. Gas output from other local and international players (excluding Tecpetrol) and YPF grew 63% and 43%, respectively, followed by majors and Tecpetrol. In February, daily gas output rose to 1.836 Bcfd (billion cubic feet per day), 15% more than the same month in 2022. Vaca Muerta’s production growth is impressive but not extraordinary, considering it is not yet a mature play. Major regional developments started just a few years ago and accelerated in 2021, as the industry recovered from the Covid-19 pandemic. So, is it possible to keep growing at similar rates for the next few years? The top figure to the left illustrates a theoretical scenario in which Vaca Muerta’s oil output reaches 1 million bpd by 2030. At this rate, Vaca Muerta could position itself at par with the Bakken or Eagle Ford plays – at 2023 production levels – which are considered worldclass US shale plays. Neuquen could become a net exporter region in which oil exports could potentially increase ten-fold compared to 2022, where revenues hit $2.28 billion – mostly from sales to the US, Brazil, Europe, Chile and Peru Scenario assumptions and evaluation of constraints Concerns about the Vaca Muerta are rarely related to the quality of the shale or its capacity to produce hydrocarbons (after proper stimulation). Its shale is distinguished by its high pressures and substantial thickness. Since the development of the play is relatively new, operators needed a period to adapt and find the ‘sweet spots’ when drilling and completing wells. The next step for Vaca Muerta operators is to standardize the use of two-plus mile laterals. The caveat, though, is that normalizing extended-reach wells requires drilling contractors to bring into the region high-spec rigs capable of handling that level of workload. This brings us to the first major bottleneck that could upset Vaca Muerta’s growth potential. With about 30 active rigs and an average drilling speed of 1.1 wells per rig per month, Neuquen’s Vaca Muerta could expect up to 400 new drilled wells within a year. Assuming the 70-30 oil-gas well completions ratio of 2022, the maximum possible number of oil wells drilled per year will, therefore, be 280.This ratio could, however, change soon with the Presidente Nestor Kirchner gas pipeline starting operations in June. If no new rigs are brought into the region, Vaca Muerta’s growth rate is set to slow in the next couple of years. Moreover, bringing high-spec rigs could potentially improve drilling rates to less than 20 days per well, like in the Permian Delaware and Bakken. On the pressure pumping side, Neuquen has eight frac fleets available, as of now, and will likely add one more later in the year. Assuming maximum efficiency, minimal downtime, and the same 70-30 ratio of completed oil to gas wells, a maximum of 315 oil wells can be put on production each year. In reality, the target is overoptimistic, and an additional fleet would be required to achieve these rates. Regarding takeaway infrastructure, Neuquen’s oil evacuation capacity is currently saturated, but a number of projects are due in the short term. If all these projects materialize as announced, Neuquen should have more than 1 million bpd of evacuation capacity by 2025. It is worth noting that if Argentina wants to become a net oil exporter, the Puerto Rosales oil export terminal in Bahia Blanca – Buenos Aires operated by Oiltanking Ebytem might need to expand in the short term to keep up with Neuquen’s volumes. One more subtle possible constraint that has become noticeable in the last few months is the lack of basic supplies such as valves and replacement parts. Limited access to foreign currencies in Argentina is resulting in local companies struggling to acquire materials and machinery from outside the country. Companies across all industrial sectors are waiting for the government to implement some way of speeding up access of dollars. This could potentially build up and limit the operators’ ability to maintain or utilize equipment at maximum efficiency. The Vaca Muerta play’s ability to produce 1 million bpd could become a reality if all industry participants strive to ease the highlighted physical and soft constraints. If these limitations are taken care of before they become urgent, the emerging shale play’s output could reach the 1 million bpd mark sooner than later. Source: Rystad Energy Shale Analytics |

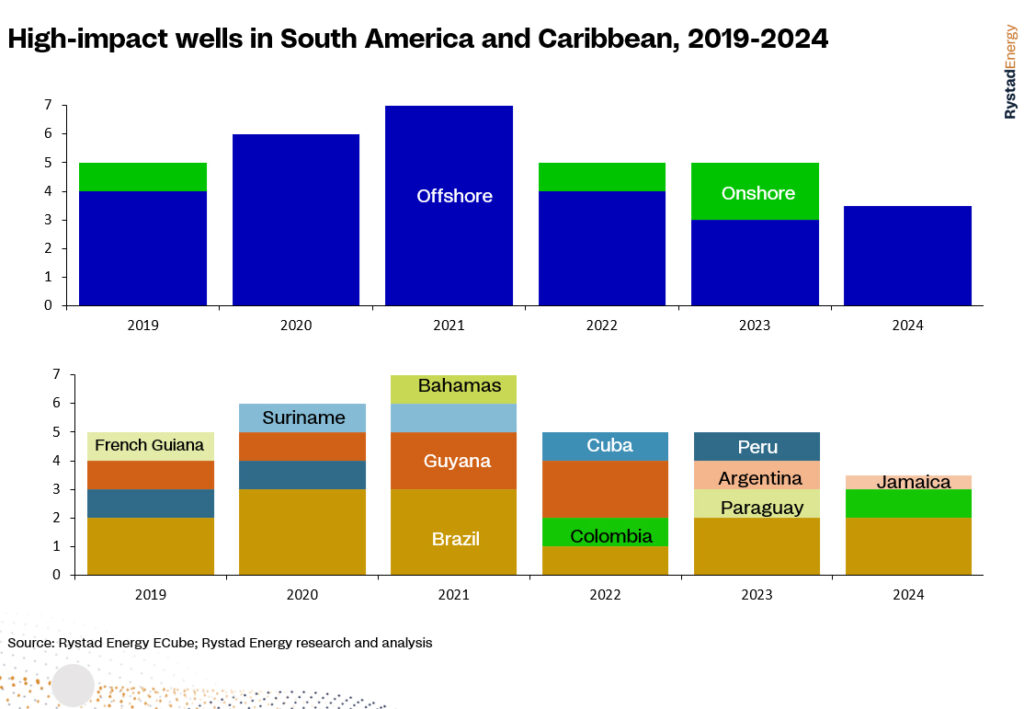

Eyes on South America’s onshore as high-impact wildcat pair near spud

Eyes on South America’s onshore as high-impact wildcat pair near spud

Industry eyes will be on a couple of upcoming high-impact onshore exploration wells in South America where positive results could inject much-needed enthusiasm and investment in the continent’s onshore sector. South America’s offshore exploration sector has traditionally stolen the limelight, with years of standout success in the pre-salt polygon off Brazil and ExxonMobil and its partners’ stunning run of discoveries on the prolific Stabroek Block off Guyana. Argentina’s offshore has become a recent focus as Norway’s Equinor and national player YPF gear up to drill the Argerich-1 wildcat on Block CAN-100, while offshore Brazil, state giant Petrobras and French major TotalEnergies have set their sights on the Morpho and Nemo prospects, respectively – although Petrobras may face regulatory challenges getting a drilling permit for the former, while TotalEnergies may have changed the name of the latter prospect. Companies operating in South America’s onshore sector are hoping to replicate some of the offshore sector’s success, with a handful of standout prospects primed for drilling. In this note, we delve into two onshore exploration campaigns set for this year involving wells classified as high-impact by Rystad Energy – the first in Paraguay led by operator Molecular Energies where is it partnered by CPC Corporation of Taiwan (China), and the second in Peru led by PetroTal.

Paraguay hopes for hydrocarbon riches at Tapir

Paraguay has set an ambitious goal to decrease its reliance on fossil fuels and increase the share of renewable energy in its overall energy consumption. By 2030, the country aims to significantly reduce its consumption of fossil fuels and promote the utilization of renewable sources. Despite its efforts to become self-reliant in terms of domestic energy needs, Paraguay is struggling to meet this ambition due to a lack of exploration and production. Preparatory work for the drilling of an exploration well is still ongoing in collaboration with Molecular’s partner, CPC. The partners have confirmed the Tapir prospect for drilling, located within the Delray Complex of prospects situated southwest of the previously considered location of Delray Main. The prospect lies in the Molecular-operated Pirity concession, which sits in the Pirity Sub-basin within the wider Chaco Basin. The Tapir prospect has estimated mean unrisked recoverable oil in place of 96 million boe, while the Delray Complex has 306 million boe. The primary focus of the well is to target the Lecho and volcanic reservoirs, and it is located on a central structural high with a clear four-way dip structure identified through 3D seismic acquired by Molecular during its original exploration campaign.

Compared to the Delray Main site, the Tapir prospect is in a more favorable location with respect to the source rock generative area and charge migration pathway. However, primary exploration risks remain, which involve migration from the source and, therefore, the existence of a charge. An independent sub-surface study commissioned by predecessor President in March 2022 indicated a 17% chance of success at the Tapir prospect. Molecular earlier this month issued an update on the drilling rig it will be using for its Paraguay operations, adding that preparations for drilling are under way. It is estimated it will take about 40 days from the start of drilling to the well to reach target depth.

Massive onshore Peru prospect ripe for exploration

Peru’s current oil and gas production is relatively modest, however the recent discovery of reserves beneath the foothills east of the Andes Mountain range in the northern part of the country could provide a fillip for its upstream sector. State energy player PeruPetro is aiming to bolster the country’s reserves by providing opportunities for oil and gas exploration. It is achieving this through direct negotiations with interested companies and offering up to 31 distinct technical contracts.

One of the most-watched upcoming exploration campaigns in Peru involves the Osheki well, primarily due to the substantial prospect being targeted. According to initial estimates, the exploration well will target mean prospective resources of over 500 million boe, which is particularly noteworthy for an onshore well – over the last decade, the most significant onshore discovery in South America was Peru’s 2012 Sagari discovery by Spanish giant Repsol, which unearthed approximately 179 million barrels of hydrocarbons. PetroTal owns and operates the Osheki-Kametza development in the Ucayali Basin. This block spans over 2,500 square kilometers and boasts Cretaceous reservoirs with oil charge from high-quality Permian source rocks, supported by a 3D geological model. Two drillable prospects, Osheki-Kametza and Constitucion Sur, have been identified through 2D seismic. Recent reinterpretation of seismic data has revealed that the Osheki prospect has two structural culminations, with Kametza being more accessible due to its smoother topography and dirt road access from the main road. As a result, the Osheki-Kametza prospect can be drilled at an estimated cost of $28 million compared to the estimated $40 million required for the Osheki surface location. The drilling cost for Constitucion Sur is estimated at $22 million.

While the industry continues to focus on highly anticipated high-impact offshore wells in South America – such as in Guyana, Suriname and Brazil – the upstream sector would do well not to underestimate the importance of onshore probes, particularly in countries such as Peru, Paraguay, Ecuador and Colombia, where previous onshore exploration efforts have yielded positive results. With production in many of the countries in decline, onshore finds can also offer the opportunity of fast-track development to swiftly bring additional volumes online. A discovery at any of the upcoming high-impact probes in Peru and Paraguay could eventually see other upstream players increasing their interest and, crucially, investment in onshore exploration throughout South America.

Source: Rystad Energy Upstream Analytics

rystadenergy.com 05 31 2023