Amilcar Flores and Sheky Espop, Platts S&P Global

MEXICO CITY

EnergiesNet.com 11 17 2023

Despite the challenging energy policy landscape in Mexico, experts at the US-Mexico Natural Gas Forum in San Antonio agree that the country’s reliance on US gas imports will continue to increase, but prices may be impacted due to growing competition in the LNG export markets.

Mexico’s gas imports from the US will be coming from the same place, Adrian Duhalt, a research scholar from Columbia University said at the panel discussion on Nov. 14. “It’s all coming from Texas,” he said.

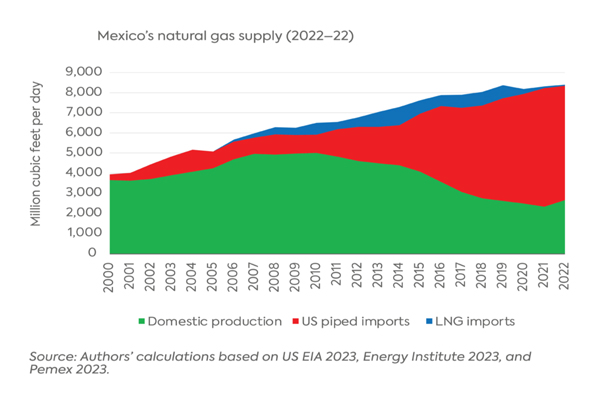

Mexico imported an average 5.7 Bcf/d of gas from Texas in 2023, with a peak of nearly 7 Bcf/d during the summer, according to data from S&P Global Commodity Insights. Furthermore, S&P Global projects this trend to continue through 2050 as US gas imports are expected to account for roughly 79% of Mexican gas supply by 2050, up from 68% for 2023.

As Mexican reliance on US gas is expected to strengthen, natural gas costs in distribution hubs in Texas could see an increase in the coming years due to competition, jeopardizing Mexico’s expectations for cheap gas availability, experts said during the conference.

Over the last four years, Mexico announced projects that would compete for cheap gas imports from the US.

State utility CFE promised to build 10 power plants with a total capacity of 6.5 GW which would utilize roughly 1 Bcf/d of additional gas. The 10 power plants are currently being built and are expected to come online by 2027.

The Mexican government has also announced the construction of around seven private LNG export terminals that would export around 50 million mt/year of gas. However, experts said there was still not enough gas flowing into Mexico to support both the power plants and the terminals.

“There are structural modifications for the pipeline system that would need to be conducted for both the power plants and the LNG terminals,” Guillermo Turrent, general manager for Energy and Infrastructure Advisors, said.

Only two of the LNG terminals announced so far are currently under construction.

“Only one of the small LNG projects will likely see the light [of day],” said Turrent, adding that the one that could get completed would be the one that takes the excess capacity in the system as it is today.

“The questions are coming,” said Javier Estrada, director of Analítica Energética. “Will [building the LNG terminals] mean that Mexican users will compete with Asian users? And does that mean that the competition will affect prices?”

Experts said part of the problem is the Mexican government has done a poor job of planning its energy policy and infrastructure needs.

That has led to the country not fully utilizing its own production, which in many cases has led state oil company Pemex to flare or burn much-needed gas. According to the upstream regulator CNH, Pemex flared as much as 12 Bcf/d during a small period in 2023 at one of its new fields because it did not expect output to be so high and lacked infrastructure to utilize it.

This lack of planning could deepen Mexico’s dependency on the US and could even extend into other commodities, they added.

“If there is no change in course, Mexico could end up importing not just gas but also hydrogen and green ammonia, which the country could produce on its own,” Duhalt said.

Project competitiveness

The LNG projects under construction are competitive compared with those being developed in the US Gulf of Mexico given their location and access to gas.

Sergio Chapa, senior LNG Analyst at Poten & Partners, said liquefaction costs in Mexico are low, and given low gas prices in Texas, the projects provide competitive costs for markets in Europe and Asia.

“Liquefaction costs are around $3.5/MMBtu and Waha prices can be even lower than $1/MMBtu,” he said, adding that this could create a pricing discrepancy in some states in the US as users would be reluctant to pay more for the molecule.

Domestic production

During 2023, Mexico’s gas production has seen a slight increase of between 200 MMcf/d to 400 MMcf/d in some months when compared to the 2022 average, due to new projects like Quesqui, Ixachi and Tupilco, latest CNH data showed. But the overall trend from 2015 has been one of decline. According to estimates from a former CNH commissioner which he mentioned during the conference, Mexico’s gas output is expected to drop to as little as 500 MMcf/d by 2030.

Currently, of the roughly 4 Bcf/d of natural gas produced in the country, 1 Bcf is unusable because of the high nitrogen content and around 2 Bcf is used by Pemex in its upstream operations, leaving only 1 Bcf/d available for the market, panelists said. In addition, lack of a distribution infrastructure makes it even harder to access that available gas.

“The country needs investment in the last mile infrastructure,” Jose Maria Lujambio, a partner at law firm Cacheaux and Cavazos, said at the conference.

More efforts needed to be made to increase the amount of power generated through clean sources, as many of the current gas-fired power plants need to be retired in the coming years given their lifespan, Lujambio said.

spglobal.com 11 16 2023