- Atlantic Basin has a shortage of octane for top-grade gasoline

- Lack of feedstocks, US rules seen as contributing factors

Rachel Graham and Barbara J Powell, Bloomberg News

LONDON/HOUSTON

EnergiesNet.com 03 20 2023

Here’s some bad news for drivers of luxury cars and large sport-utility vehicles who are pumping the top grade of gasoline: the premium they pay over regular fuel is getting pricier.

US and European refiners are scrambling to get enough octane to make high-quality gasoline. There are several potential reasons for the shortfall, including the fallout of Russia’s war in Ukraine, the impact of US environmental regulations and a lack of refining capacity.

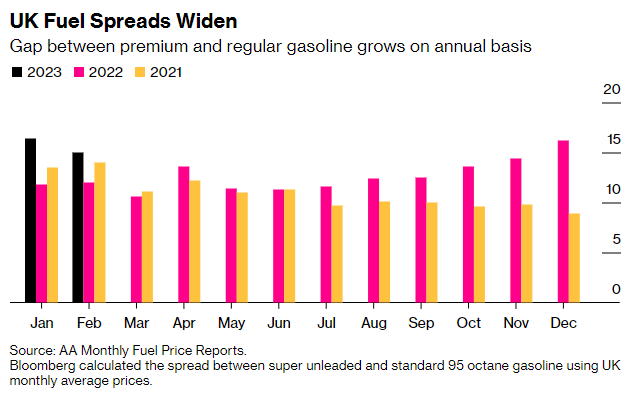

The net effect is that it’s making the fuel even more expensive than usual, when compared to regular unleaded. In the US, the price gap is around 75 cents a gallon — about 15% more than during the same period last year — data from automotive group AAA show. In the UK, the premium has widened by 25% on an annual basis, the most recent monthly data show.

Bloomberg calculated the spread between super unleaded and standard 95 octane gasoline using UK monthly average prices.

“The current record seasonal strength in octane pricing doesn’t portend well to a smooth transition to summer-specification gasoline,” said Callum Bruce, an analyst at Goldman Sachs Group Inc.

Refiners are in the process of making the switch to summer-grade gasoline. Winter fuel contains more butane from natural gas processing to increase octane.

Gasoline Production

Octane itself is a hydrocarbon, produced in the refining of crude oil, though consumers generally know about it through the so-called octane rating for gasoline. A higher value means the fuel is more stable and less likely to cause engine knock. Vehicle manufacturers often recommend high-octane gasoline — the premium grades at the pump — to get peak performance from turbo-charged or high-compression engines.

Even regular gasoline contains octane. However, the shortfall shouldn’t be problematic because there are more low-octane components available for making regular gasoline than high-octane fuel.

The European Union and the UK last month banned most seaborne imports of Russian petroleum products, reducing the region’s supply of naphtha, a key component in making gasoline. Meanwhile, the European petrochemical industry has cut supply of octane-boosting additives as high energy costs and weak demand curbed operations.

The loss of these Russian feedstocks is critical for gasoline markets this year, according to consultant Energy Aspects Ltd.

‘Explosive’ Price Gains

Separately, US “Tier 3” environmental regulations, which require lower sulfur content in gasoline, have created complications.

Compliance with the rules requires more severe hydrotreating of naphtha and gasoline during refining. The process destroys octane, thus contributing to a shortage and helping to widen the value of premium gasoline to regular grade.

The gasoline sulfur standard for the rules took effect in 2017. In 2020 fuel demand dropped due to pandemic-related travel restrictions. The true effects of the regulations started to become clear last year as gasoline consumption recovered, according to analysts at Bank of America Corp.

“Meeting lower sulfur requirements comes at the expense of octane levels, which likely contributed to soaring prices for high octane blending components,” they said in a recent note. “This dynamic should continue in 2023 and may lead to similar explosive upside in gasoline prices this summer.”

To be sure, there is debate on what’s behind the octane shortfall. Wide octane spreads — the price difference between wholesale prices for premium and regular-grade gasoline — were primarily driven by a shortage of refining capacity, according to Robert Auers, manager of Refined Fuels Analytics, a division of RBN Energy.

Because of the lost capacity, there aren’t enough reformer units to upgrade low-octane naphtha, to raise its octane levels for use in making premium gasoline. That may eventually change as new refinery capacity comes online this year. “Still, we have octane spreads staying moderately wide,” Auers added.

— With assistance by Jack Wittels, Ilena Peng and Chunzi Xu

bloomberg.com 03 17 2023