- Week 41 of 2023, Report on ideas to obtain a positive cash flow.

Market Report

Update of material financial information

October 8, 2023

1 Macroeconomic Environment:

Past Week:

These indicators were shown:

Trade in goods and services. Continues to be very healthy trade in the USA.

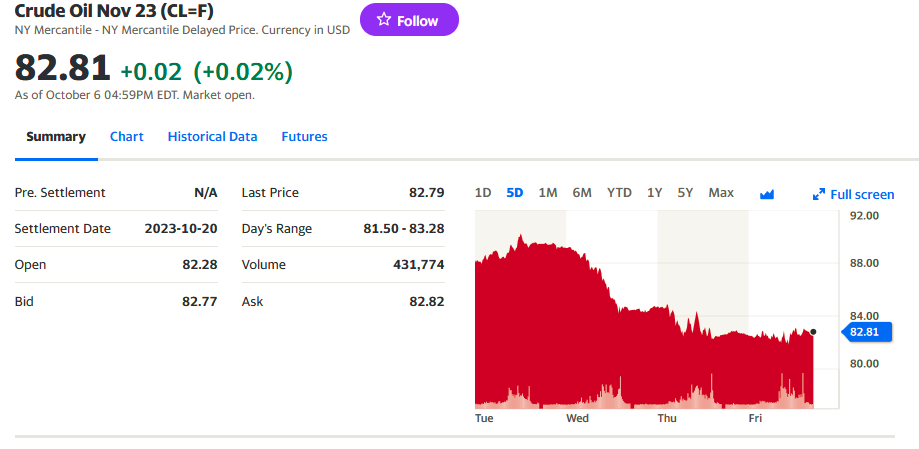

Oil continues to decline , US stockpile inventories are stable at 17 days of inventory . Now with the military attack on Israel there should be a relevant rise .

Treasury bond yields started the week strong and on Friday declined on the already digested employment numbers .

The 10-year Treasury bond closed at 4.78%, a resistance zone.

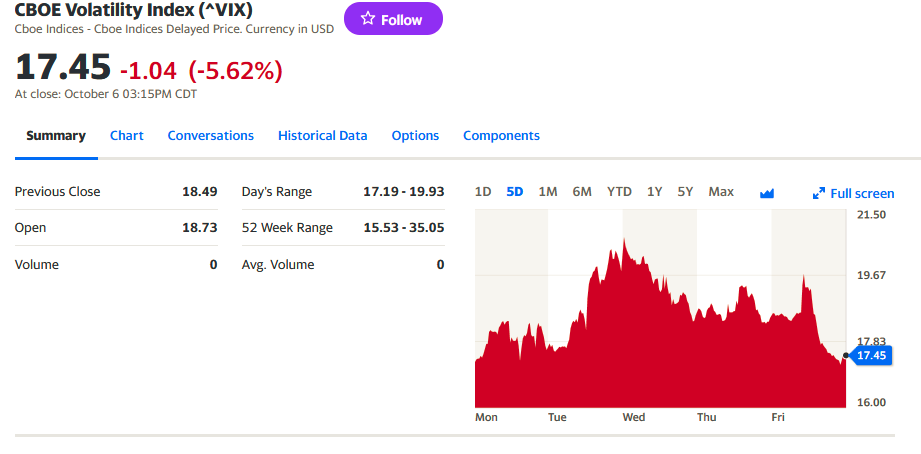

The VIX, which measures volatility, traded as high as 20.73, in the face of stock market jitters, but gave up some room at the end of the week.

The WTI crude oil marker fell by -6% during the week.

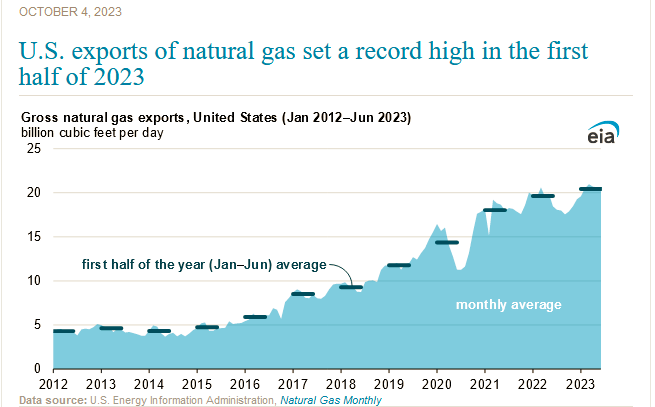

EIA reported the maximum growth in Natural Gas exports in the first half of 2023:

Next Week

The most relevant news will undoubtedly be the development of the conflict in the Middle East.

The reaction of the extremists to the agreements reached between Israel and Saudi Arabia, with the eyes of the Western world on them, will be the thermometer that will measure the behavior of economic and political indicators.

In the US, it will be a very active week due to the above and the release of the CPI inflation and PPI production data, as well as the FED minutes of its last meeting.

2 Micro

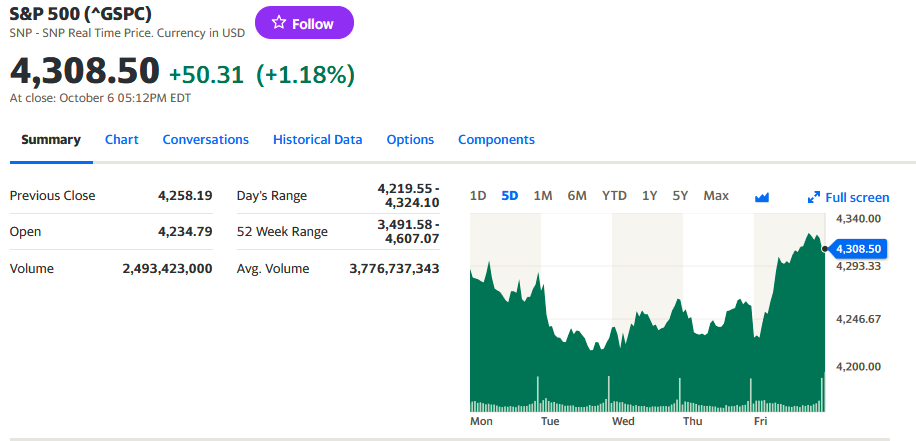

The stock market, SP500 rose +0.3% in weekly total, noting that the weekly low was -1.68% last Tuesday and on Friday broke the 4,300 resistance.

It did not reach 4,200 and is above 4,300, we remain vigilant with that range.

3 Build a long-term portfolio

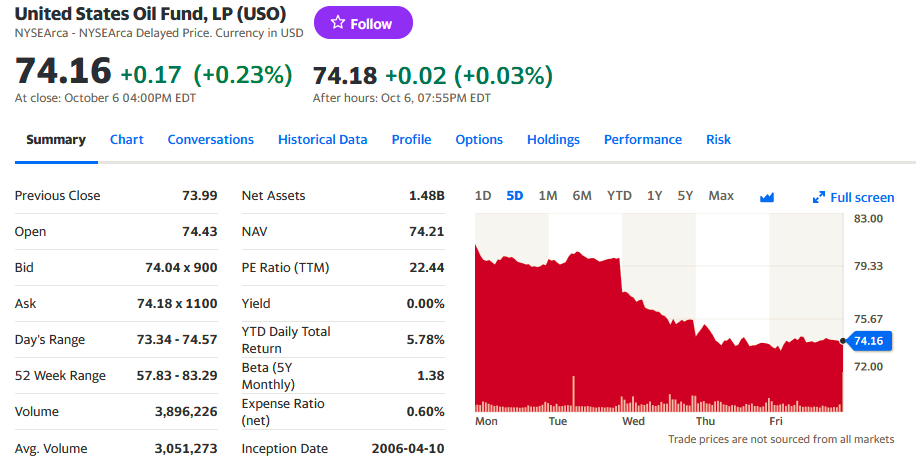

The two energy-focused funds were shaken by the news. What’s more, they will be shaken a lot more by the instability in the Middle East this week going forward:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO, which trades short crude oil futures contracts, gained an impressive +16.06% in one week.

Meanwhile, the United States Oil Fund USO, which, in addition to crude oil futures, holds futures on natural gas, diesel and gasoline, also showed great volatility, falling -8.27%.

In radical moments we observe how these two funds give results of 8% doing arbitrage, interesting observation

4 Running an algorithm or method to generate cash flow on a long term portfolio or with money in the account.

Our favorite strategy.

The Magnificent 7, AAPL, TSLA, MSFT, GOOGL, NVDA, AMZN and META, showed weekly gains . CME’s FedWatch tool shows that the market is now pricing in a 73% chance that rates will not change at the November meeting and 27% that they will. Less fear last Friday, tomorrow Monday there will be impact from the Middle East. Microsoft is the winner of the week.

In radical moments we observe how these two funds give results of 8% doing arbitrage, an interesting observation.

5 Analysis of results from the previous week’s forecast

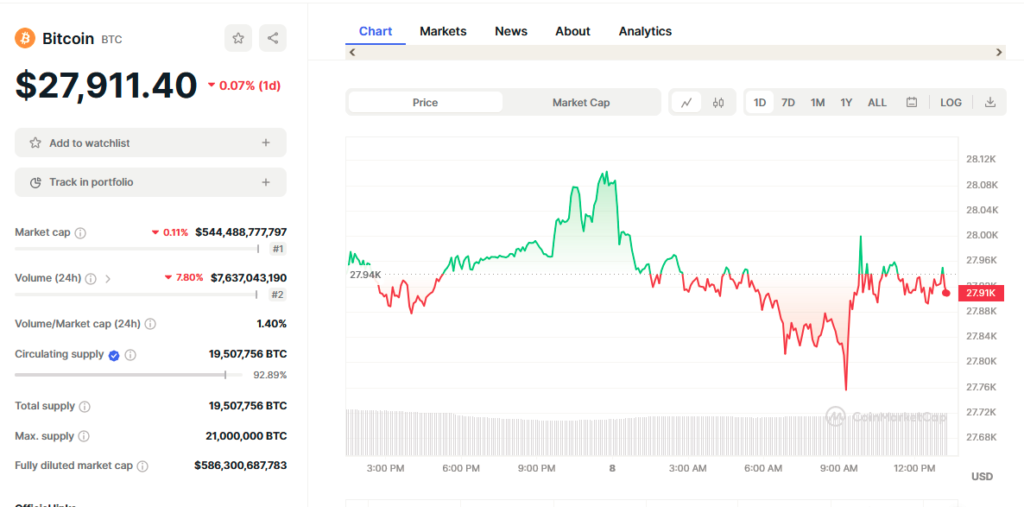

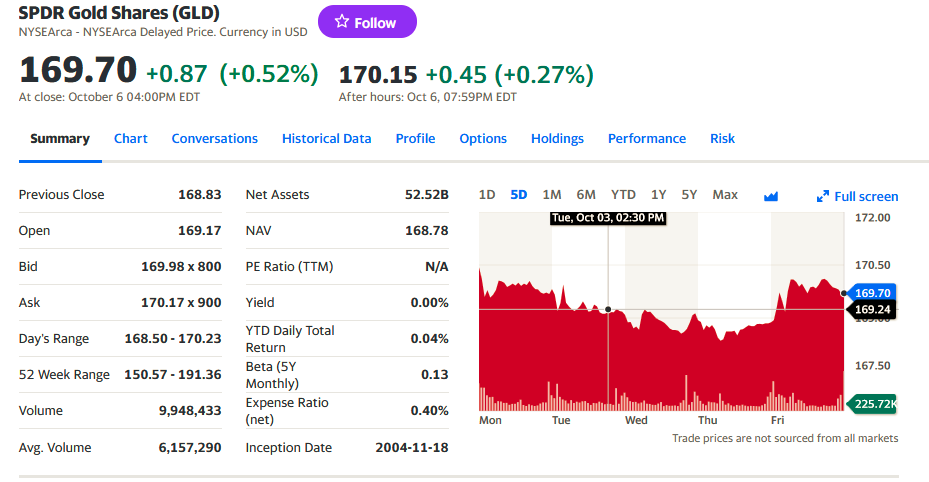

From our analysis , we suggested looking at Gold , through the bottom the GLD and Bitcoin which had had lows to support points.

This week’s results were :

Gold +0.59%

GLD -0.43%.

Bitcoin: +2.53%.

Result of the observation of results between the GLD and the Bitcoin : +2.10% for the week.

6 Forecast for next week:

Second week of October , active investment algorithms taking into account quarterly earnings considering historical DATA (Back Testing) which should favor high tech companies, less energy and utilities.

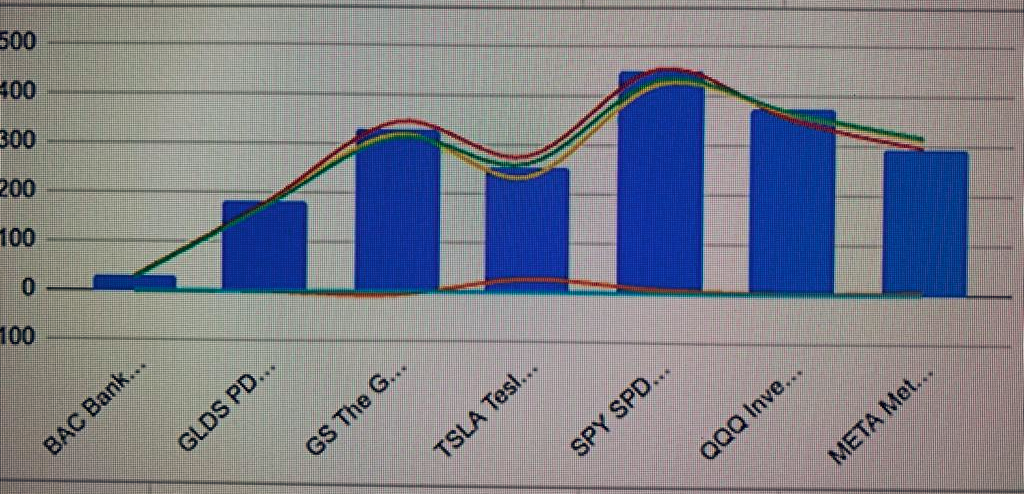

Weekly performance of the US $1,000 challenge for comparison between:

BAC Bank of America Corporation 29.04 29.33 27.07 26.07 -1 -3.69%.

GLDS PDR Gold Shares 180.5 176 170 169.7 -0.3 -0.18% GLDS PDR Gold Shares 180.5 176 170 169.7 -0.3 -0.18%

GS The Goldman Sachs Group, Inc. 328 344 319 312.48 -6.52 -2.04%

TSLA Tesla, Inc. 252 276 234 260.53 26.53 11.34% TSLA Tesla, Inc. 252 276 234 260.53 26.53 11.34%

SPY SPDR S&P 500 ETF Trust 449 452 422 429.54 7.54 1.79%

QQQ Invesco QQQ Trust 374 351 362 364.7 2.7 0.75% 0.75%

META Meta Platforms, Inc. 294 295 311 315.43 4.43 1.42% 1.42% 4.43 1.42

Graph of our portfolio since inception 5 weeks ago.

Venezuelan market

Price of the dollar vs Bs

BCV : Bs 34.74

Unofficial : Bs 37.31

Caracas Stock Exchange

Fixed Income:

OPERATIONS NOMINAL AMOUNT (BS.S) CASH AMOUNT (BS.)

4 3.014.415 3.500.344,65

Variable Income:

OPERATIONS TRADED SECURITIES CASH AMOUNT (BS.)

118 268,372 284,370,8

Up: 4

Down: 5

Equals: 17

_______________________

For questions about our Algo daily entries, please write to : editor@petroleumworld.com

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management contact : editor@petroleumworld.com

__________________________________________________

Raul Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and published on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 08 10 2023