Julian Lee, Bloomberg

LONDON

EnergiesNet.com 09 30 2024

A growing number oil tankers that were sanctioned for their role in transporting Russian petroleum are finding work again — a blow to western authorities who sought to clamp down on the vessels in an effort to hurt Moscow’s access to petrodollars.

Since late April, at least 17 cargoes of crude and refined products have left Russian ports on ships sanctioned by the US, UK or European Union in response to Moscow’s 2022 invasion of Ukraine. Most have been carried on vessels that were owned by Russian tanker giant Sovcomflot PJSC at the time they were designated.

In the immediate aftermath of sanctions, the vast majority of the tankers targeted were left idling, some for as many as eight months.

But shippers have been steadily ramping up the use of blacklisted vessels after the successful delivery of cargoes to China — carried for at least part of their voyages on tankers sanctioned by the West with their location beacons turned off. Now, the tankers are no longer trying to hide their movements, with cargoes openly delivered to both China and India.

Sovcomflot, also known as SCF, has no connection to the countries imposing sanctions and as such isn’t subject to UK, EU or US measures, the company said in response to questions. “Hence, SCF cannot be regarded as an ‘offender’ nor as a tool to undermine sanctions.”

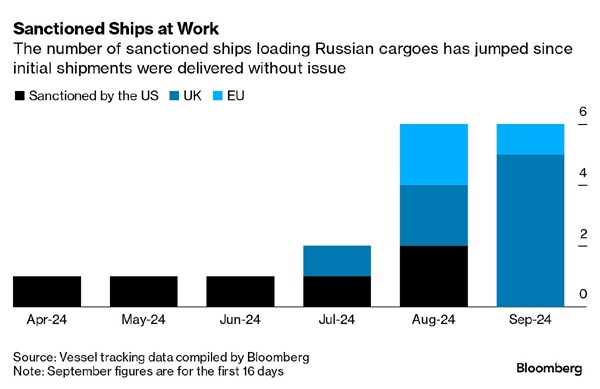

The use of sanctioned tankers accelerated in August and is on course to surge further this month.

If the trend continues, it will ease logistical constraints that had arisen. Even so, Russia had by and large managed to find the ships it needed even when more were held up.

Acceleration

Six vessels targeted by at least one of the US, the UK or the EU loaded Russian cargoes last month, a figure that’s already been matched in September.

Having previously hidden their movements from digital tracking systems, the sanctioned ships are also delivering oil more transparently again.

With another 11 sanctioned tankers anchored near the Russian Pacific port of Kozmino, seven sitting idle off Ust-Luga, another three that have been in the Black Sea for months and two off Murmansk, there are ample opportunities for more blacklisted ships to be brought back into use in the second half of September.

Among the ships in question, the Viktor Bakaev, took on a cargo of about 730,000 barrels of Urals crude at the Baltic port of Primorsk on July 21.

After leaving the Baltic through the environmentally fragile Danish Straits, the tanker turned north, hugging the Norwegian coast before setting off along Russia’s Northern Sea Route, picking up an icebreaker escort for the final part past Wrangel Island, before turning south for the Bering Strait and an eventual destination at Dongying in China.

The same route along Russia’s northern coast was subsequently followed by the sanctioned tankers Galaxy and Zaliv Ammurskiy, both taking on cargoes at the Arctic terminal of Murmansk.

Two others — the Bratsk and Belgorod — having previously disappeared from digital tracking systems during their first voyages under sanctions, openly hauled their subsequent cargoes to China, arriving earlier this month.

bloomberg.com 09 27 2024