(Bloomberg)

Caleb Mutua, Bloomberg News

NEW YORK

EnergieNet.com 02 27 2024

Raizen SA, the world’s biggest supplier of ethanol made from sugar cane, is considering selling bonds meant to benefit the environment, according to a person with knowledge of the matter.

The company, through its subsidiary Raízen Fuels Finance SA, asked a group of banks to arrange a series of fixed-income investor calls starting on Monday, Feb. 26, said another person.

The company has a program in place to sell debt for funding environmentally-friendly projects, the proceeds of which can go toward efforts including boosting energy efficiency at sugarcane ethanol biofuel plants and purchasing more efficient equipment, according to documents it released in 2022.

A representative for Raizen declined to comment.

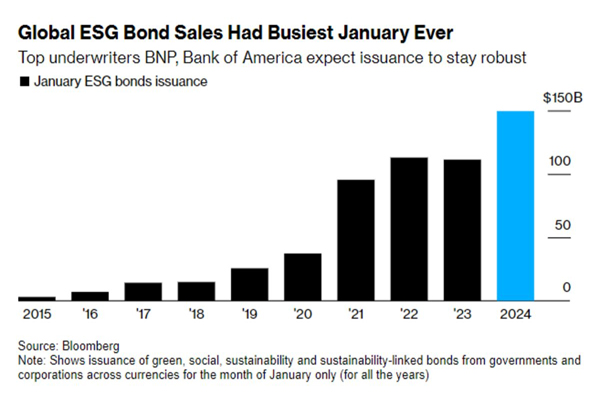

Latin American companies and governments have joined in on the global sustainable finance sales rush this year. Borrowers in the region have raised about $6.2 billion in ESG bonds denominated in US dollars and euros this year through Feb. 26, a more than triple the level of the same period last year, according to data compiled by Bloomberg.

Raizen Fuels Finance on Monday also kicked off an offer to purchase outstanding notes due 2027 issued by Raizen Fuels with a coupon of 5.3%.

Raizen company is shifting to using cane residuals to make biofuels rather than burning waste to generate electricity for its industrial processes. Raizen said last week it’s considering building a sustainable jet fuel plant in Brazil — the top sugar-cane-growing nation — given that production of the fuel requires such large volumes of cane and byproducts.

The company, owned by Shell Plc and Cosan SA, secured a €300 million green loan granted by a group of international banks led by BNP Paribas SA in November.

–With assistance from Dayanne Sousa.

bloomberg.com 02 26 2024