- Platts’ Dated Brent assessment jumped by more than $6 Monday

- Prospect of tighter market for crude is boosting sentiment

Sherry Su, Bloomberg News

LONDON

EnergiesNet.com 04 04 2023

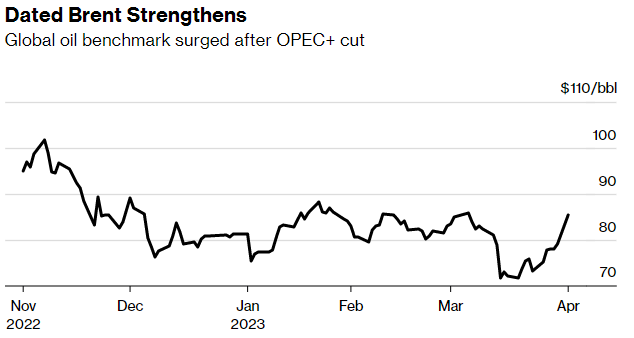

The OPEC+ alliance’s surprise production cut and looming strikes by North Sea oil workers have boosted a key measure for oil prices across the globe.

The Dated Brent benchmark jumped to $85.51 a barrel on Monday, up by $6.45 from Friday, according to its publisher S&P Global Commodity Insights, better known by traders as Platts. That’s the the biggest increase so far this year.

Dated Brent is the world’s most important oil benchmark, used to set prices of more than two-thirds of crude oil in the world. Oil-producing states often sell their barrels at small premiums or discounts to “Dated,” as it’s known in the industry. The benchmark serves as an indicator of the physical market for crude and acts as an anchor for Brent futures traded on exchanges.

On Sunday, a group of countries from the OPEC+ alliance announced a surprise oil production cut of more than 1 million barrels a day, sending a shock wave through the global oil market. Meanwhile, about 150 workers providing services to oil and gas companies operating in the UK North Sea plan to strike for 48 hours starting April 5. This will affect production platforms operated by companies such as Shell Plc.

Physical oil prices in the North Sea rose on Monday. Trafigura Group and Mercuria Energy bid at higher prices for various North Sea grades in the pricing window on Platts, though no offers emerged.

Some derivatives of Brent also strengthened. Dated to Frontline Brent swaps — which reflect the premium of real-world North Sea crude supplies over ICE Brent futures — rose to a premium of 41 cents a barrel Monday, compared with a discount of 44 cents a week ago, according to data from broker PVM Oil Associates Ltd.

While the output cut and the strike action add to the prospect of a tighter market, other factors could provide some relief — at least for now. Continuing strikes at French refineries have curbed demand for crude. Millions of barrels of West African crude, normally consumed by European refiners, are still struggling to find home.

Forecasters including the International Energy Agency expect global demand to increase later this year, particularly as China’s consumption rises.

— With assistance by Sharon Cho

bloomberg.com 04 04 2023