Market Report

Week #5 of 2024, Report on ideas for positive cash flow.

Update on relevant financial information.

January 22 to February 2, 2024.

1 Macroeconomic Environment:

Week ending:

Loaded with news.

The Fed left rates unchanged.

Tech earnings flew , especially Meta and Amazon. It has been a while since a stock in Meta’s category has seen a 20% gain in one day, driven by earnings and forecasts in 2024,

The owners of Tick tock and Meta were questioned in the US congress and had to apologize for the collateral damage of social networks. A very complicated issue.

The unemployment rate reached 24 months below 4%, the third longest streak since 1948, post-war.

Reverse Repos continue to rise as shown in the chart, liquidity continues to flow into the system and the Fed drains what appears to be excess.

The 10-year bond rises in price

Corporate bonds, on the other hand, fell in price, a sign of stabilization for the time being.

Próxima Semana

Se observa en el gráfico que entre los analistas económicos 62% opinan qué no subirán y 38% que sí, se sabrá el 20 de marzo próximo.

CME FedWatch Tool

2 Micro

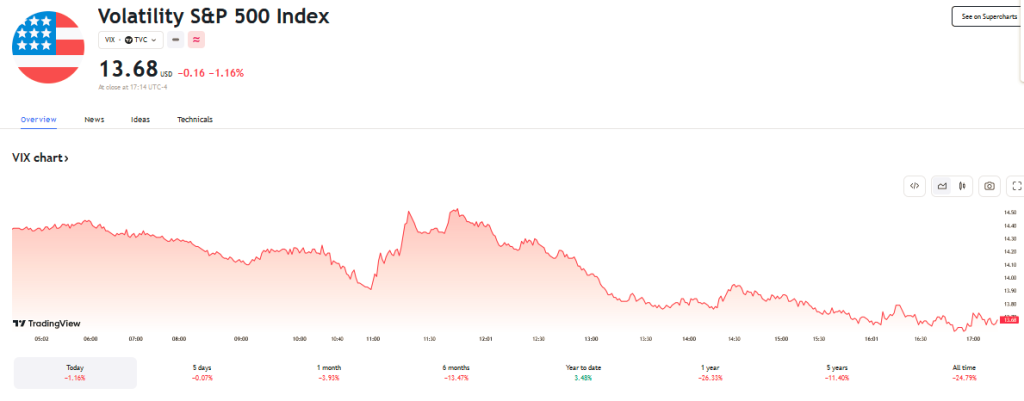

The S&P 500 fell 1.6% on Wednesday, the first daily drop of 1% or more this year. Since 1928, the average year has 29 such declines. It was a very soft January so far today; more volatility is expected.” Knowing that the data favors more volatility going forward, now is the time for investors to understand how to manage that volatility. It is between 13 and 14.5

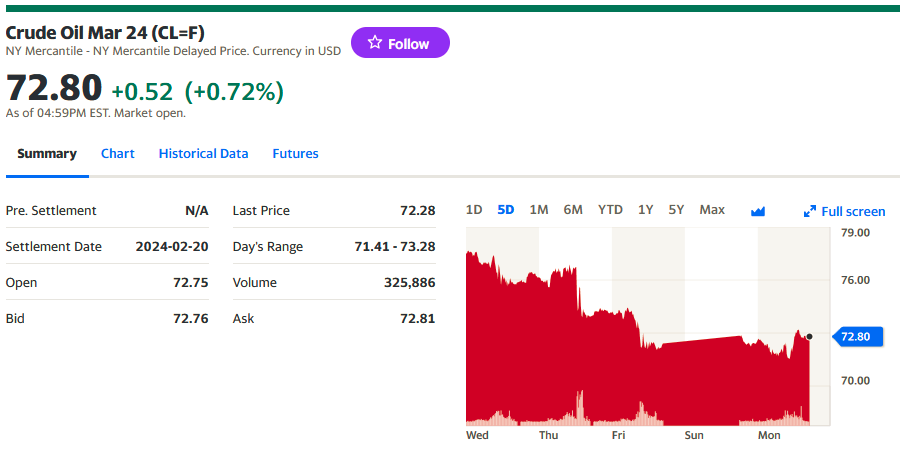

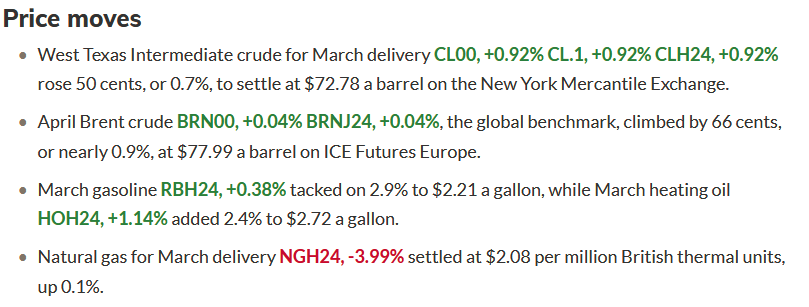

Oil prices had a -6.7% drop for the week. Oil spills in Yemen and elsewhere have not calmed prices.

Oil posts its biggest weekly loss since October

Oil futures hit a three-week low on Friday, contributing to their biggest weekly decline since October.

News reports citing Qatari officials and indicating that a ceasefire between Israel and Hamas and a hostage deal was imminent had triggered a massive sell-off in oil on Thursday, but Qatar later clarified that an agreement had not yet been reached, Reuters reported.

U.S. WTI oil futures lose over 7% for the week.

Closing Prices : Friday, February 2. 2024

Bitcoin volatile with no direction on the week.

3 Building a long-term portfolio

This week the energy ETF markets moved like this:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO which works with short crude oil futures contracts, gained +11% in one week.

Meanwhile, the United States Oil Fund USO, which contains not only crude oil futures but also natural gas, diesel and gasoline futures, with less volatility, is down +5.9%.

The arbitrage between the prices of both funds was a +5% weekly difference.

4 Execution of an algorithm or method to generate cash flow on a long term portfolio or with money in the account.

Our procedure involves reviewing volumes, volatility, technical analysis on short and long term support and resistance charts.

This is our favorite strategy.

The Magnificent 7, which drive the price indexes due to their traded volumes, were flying in the face of Amzn’s gains, Meta , here the chart of the fund that groups them together. MAGS

5 Analysis of last week’s forecast results

Contained volatility, movements are coming, the protagonists are the magnificent ones.

Watch video

6 Forecast for next week:

We will compare and hypothesize with oil , Gold, SPY, crude and 10-year Bond yields.

Incoming liquidity rises. Again sign of appetite for equities.

We will use our method for stocks in ranges of 4,900 support and 4975 resistance in the SP500 for entries and exits.

Weekly performance of the US $1,000 investment challenge, over 18 weeks:

BAC Bank of America Corporation

100,188}

GLDS PDR Gold Shares

198,55

GS The Goldman Sachs Group, Inc.

104,96

TSLA Tesla, Inc.

100,8

SPY SPDR S&P 500 ETF Trust

269,4

QQQ Invesco QQQ Trust

108,46

META Meta Platforms, Inc.

117,6

Amount $ 999,958

Yield 100.00%.

The portfolio is yielding 19.67%, due to the rises in Meta

Venezuelan market

Price of the dollar vs Bs

BCV : Bs 36.23

Unofficial : Bs 38.09

The price of the parallel dollar goes down.

NOTE: We do not recommend investments, we only give our opinions.

______________________________________________________

Raúl Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 06 02 2024